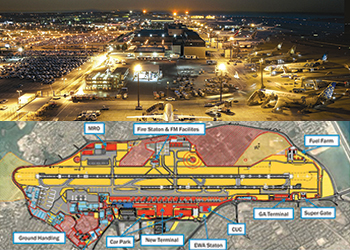

Muscat International Airport ... work in progress.

Muscat International Airport ... work in progress.

The Gulf is cementing its status as a major force in commercial aviation, with state-of-the-art facilities being developed the region, writes ABDULAZIZ KHATTAK.

The GCC’s aviation sector has witnessed phenomenal growth over the past two decades, thanks to the region’s booming economy and increasing industrialisation, the influx of business and leisure travellers as well as of workers, and its growing population.

In addition, Middle East carriers, particularly those based in the GCC, have transformed the region into a global aviation hub, offering attractive deals as transit points between the East and the West.

To meet the demands of travellers and expanding airlines, the GCC is pumping billions of dollars into building new airports and expanding existing facilities.

The UAE leads the way in terms of investment in airport infrastructure with massive developments both in Dubai and Abu Dhabi, as well as the other emirates which are also launching expansion plans of their own. Next in line is Saudi Arabia which is eyeing a combined future capacity of 140 million passengers per year by expanding its major airports, notably in Riyadh and Jeddah.

With the region gearing up for two major global events in the next 10 years – Expo 2020 in Dubai and Fifa World Cup 2022 in Qatar – and Saudi Arabia already hosting millions of pilgrims every year, the number of passengers is expected to grow substantially and will put pressure on the existing facilities.

“As Gulf’s airlines grow, so does the congestion in the region,” said Tony Tyler, the International Air transport Association’s (Iata) director-general and CEO, on the sidelines of the organisation’s annual general meeting and the World Air Transport Summit held in Miami, US, last month (June 7-9).

While the Middle East carriers, especially those based in the GCC, have grown phenomenally, Tyler said, “one of the challenges faced by the GCC countries is the mounting air traffic congestion in their airports. In whatever ways possible, we (Iata) will help find a solution to the problem”.

Also, the region’s airlines are investing in larger jets such as the giant Airbus A380, which has increased the need for facilities with larger handling capacities.

UAE

Dubai World Central’s Al Maktoum International Airport expansion – budgeted at $32 billion and billed as the biggest airport in the world – is the region’s most ambitious aviation project. Spread over 56 sq km, the airport will have the capacity to handle 12 million tonnes per year (tpy) of cargo and 160 million passengers once completed.

Following the completion of the first phase – which is now fully operational – work is currently under way on Phase Two of Al Maktoum airport. Phase One has the capacity to handle 600,000 tpy of cargo and operates 24 hours a day on an A380-compatible, 4.5-km runway.

Phase Two of the airport, which includes the construction of an additional two cargo terminals, is expected to increase the total cargo capacity of the airport to 1.4 million tpy. The airport will also be able to accommodate one hundred A380 aircraft at any one time.

Meanwhile, Dubai Airports has embarked on a $7.8-billion airport expansion plan that will boost the capacity at Dubai International Airport from 60 to 90 million passengers per year by 2018. The plan involves the construction of additional terminal space and concourse areas spanning an extra 675,000 sq m of floor space. It also expects cargo handling capacity to reach 4.1 million tonnes by 2020, up from 2.2 million tonnes in 2010.

The work includes the $517-million extension of Terminal One to introduce Concourse D, which will be home to nearly 100 airlines that currently occupy Concourse C. A further $490-million is currently being invested on a phased refurbishment of Terminal One.

A further $163 million is being spent on upgrades to Terminal Two including a more spacious check-in area, an expanded transfer area and more immigration counters.

In the UAE capital, the Abu Dhabi Midfield Terminal is being built over 700,000 sq m area at an estimated cost of $2.9 billion. A joint venture of Arabtec, CCC and TAV is constructing the striking ‘X’-shaped facility, which will double the airport’s handling capacity to 30 million passengers annually.

|

|

King Abdulaziz International Airport in Jeddah ... under way. |

Saudi Arabia

Home to Islam’s holiest cities, Makkah and Madinah, Saudi Arabia hosts millions of pilgrims every year. The kingdom is currently working on a number of airports to meet rising demand and ease pressure on existing facilities.

In Jeddah, the $7.2-billion expansion of King Abdul Aziz International Airport will include the world’s tallest air traffic control tower once complete, standing at a height of 136 m. The expansion includes the construction of a new 690,000-sq-m terminal, which will increase the airport’s capacity to handle up to 32 million passengers a year. The airport is expected to begin operations by early 2016.

Meanwhile, the Prince Mohammed bin Abdulaziz Airport in Madinah is the first airport in the region to be fully built on the public-private partnership (PPP) model. The project has been designed mainly to cater for the influx of Hajj and Umrah pilgrims every year with a capacity to accommodate up to eight million passengers.

Among the smaller airport projects, Saudi Arabia’s General Authority of Civil Aviation has given the go-ahead for the expansion of Prince Naif Regional Airport in Al Qassim (see Saudi Focus).

Work is also under way on the Abha Airport project, which will include a new passenger terminal with an area 86,000 sq m that has been designed to accommodate five million passengers annually.

Oman

After a series of delays, the expansion and modernisation of Muscat International Airport is now at an advanced stage. At an estimated $5.2 billion in project costs, the new airport development is billed as the single biggest civil construction undertaking in Oman’s modern history. It has included the construction of a state-of-the-art passenger terminal building, a 100-m-tall air traffic control tower, two runways, more than 7,000 parking spaces, a civil aviation headquarters and an air cargo terminal.

Phase One of the development is in an advanced stage of completion. Over the next three phases, the airport’s handling capacity will be progressively ramped up to 24 million, 36 million and 48 million. This represents a quantum leap over the airport’s present capacity of three million passengers per year, which in reality handles 7.5 million passengers and 40 airlines.

The Public Authority for Civil Aviation (Paca), which is overseeing the execution of the project, has its sights on an end-2016/early-2017 timeframe to bring the ambitious scheme into operation.

Meanwhile, the new Salalah Airport began operations last month (June). The passenger terminal is spread over 65,000 sq m and will serve over two million travellers per year in the first stage. The main runway is 4 km long and 75 m wide and can receive the largest airplanes including the A380.

The airport has been designed to allow for further expansions to cater for future demand growth to six million passengers.

Work is also expected to start on Sohar Airport. When operational, the airport will also serve as an alternative to Muscat International Airport. The airport is expected to handle 250,000 passengers per year and up to 50,000 tpy of cargo.

Bahrain

Bahrain International Airport has embarked on its $1-billion airport modernisation programme that will boost its capacity to 13.5 million passengers. Tenders for the main construction contract are expected this month (see separate article).

Aéroports de Paris Ingénierie (ADPI), a wholly owned subsidiary of Aéroports de Paris, is overseeing the project which includes the construction of a new passenger terminal.

Kuwait

Kuwait is expected to retender the contract for the construction of its new $3-billion terminal, after the lowest bid exceeded the estimated cost of the project. At the end of last year, Kharafi National submitted the lowest bid of $4.8 billion for the contract. The expansion of Kuwait International Airport is expected to boost its capacity from six million passengers a year to 25 million.

.jpg)

(1).jpg)