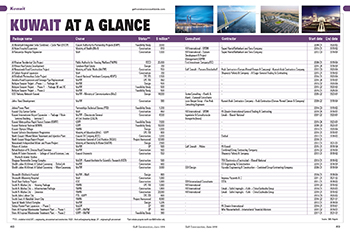

Sheikh Jaber Al Ahmed Al Sabah causeway ... one of the largest infrastructure projects in the GCC.

Sheikh Jaber Al Ahmed Al Sabah causeway ... one of the largest infrastructure projects in the GCC.

An ambition to be a regional trading and logistics hub is driving Kuwait towards new horizons as the country makes determined efforts to spearhead the development of its transportation sector.

While the oil sector continues to dominate the nation’s economy, transport is emerging as a vital area of growth. Kuwait’s 2018-2019 development plan covers 20 major projects worth KD21.7 billion ($69.1 billion), according to the local Arabic language daily Al Nahar. Of these projects, Kuwait’s massive hydrocarbons sector has the lion’s share with a value of KD11.9 billion, accounting for nearly 55 per cent of the total, said the report. The transport sector is the second largest beneficiary with five projects with a combined value of KD4.49 billion, including Kuwait’s international airport expansion, which is currently under way.

At the Kuwait Investment Forum 2018 (KIF2018) held in March, Kuwait’s director general of civil aviation indicated that the country is considering building a new greenfield $12-billion world-class airport to meet the rapid growth in air traffic. This announcement by Sheikh Salman Sabah Salem Al Humoud Al Sabah has reaffirmed Kuwait’s commitment to pursue its ambition.

In fact, some of the largest projects currently propelling the country’s construction sector are transport related, namely the new $4.27-billion passenger terminal at Kuwait International Airport, the $3-billion Sheikh Jaber Al Ahmad Al Sabah Causeway and the $12-billion Mubarak Al Kabeer Port at Bubiyan Island and a series of mega road development schemes.

The focus on the transportation sector is also evident from the contracts awarded in the first quarter of this year. According to a recent National Bank of Kuwait (NBK) Economic Update, the transport sector accounted for some 46 per cent of the total value of contracts awarded in Q1, worth KD283 million of the total value of KD614 million. These awards were for five projects in the sector – two of which were for regional roads. The report added that up to KD780 million in transport contracts are expected over the next few quarters.

Growth in transport infrastructure will be driven over the long term by the government’s ‘Kuwait 2035’ initiative or the ‘New Kuwait’ economic plan, which aims to transform Kuwait from a petro-state to a financial, logistics, and trade hub by 2035. The forward-focused roadmap aims to triple revenues, reform the education system and streamline regulations so as to encourage the private sector to join hands with the government in driving infrastructural growth.

Social housing is another key sector that continues to be prioritised with one of the largest deals awarded last year – valued at KD212 million – having been for the infrastructure works at the South Al Mutlaa City.

Another avenue to economic diversification that the government is now focusing on is industrialisation, gauging by the recent plans announced by Kuwait’s Public Authority for Industry (PAI) to establish a $6.6-billion industrial city. To be built 70 km west of Kuwait City, Al Nayeem industrial city is to be developed as a smart integrated city powered by solar energy that complement the goals of Vision 2035. It will focus on diversifying Kuwait’s industrial base, bringing high-end technology and creating higher value-addition, Abdulkareem Taqi, PAI acting general manager announced at the recent KIF2018 forum. Some $600 million would be spent by the government in developing the infrastructure, which is scheduled to be completed by 2021.

Meanwhile, key projects in the country’s 2018-2019 development plan are joint public-private ventures spearheaded by the Kuwait Authority for Partnership Projects (KAPP) including a $10-billion rail network project, Al Jahra labour city and Kabd solid waste management plant.

Over recent years with the drop in oil revenues, Kuwait has increasingly looked at attracting private sector participation and despite the current increase in oil prices, the nation is likely to continue to pursue the privatisation path going forward. The proposed $12-billion new airport is one such project on the anvil.

The private sector is also keenly pursuing investments in real estate with the country currently witnessing a surge in mixed-use destinations and commercial complexes.

According to the latest infrastructure report on Kuwait by BMI Research, growth in the construction sector is expected remain moderate in the coming years, because of the political situation in the country which continues to impede the effective allocation of infrastructure investment.

The research firm maintains its 2018 real growth forecast at 5.1 per cent and its average five-year outlook at 4.2 per cent, expecting deficit spending and greater private sector participation.

Airports & Ports

|

|

Kuwait International Airport ... a new passenger terminal is under construction with a capacity to handle 25 million passengers. |

Kuwait is considering issuing tenders for a world-class mega airport, according to the country’s director general of civil aviation. Sheikh Salman indicated that the new airport will have a capacity of 25 million passengers a year and would be located in northern Kuwait, which would facilitate the establishment of an integrated facility to provide all transport and logistic services. The private sector is expected to build, operate and manage the project on land allocated by the government.

He stated that the Kuwait International Airport saw a 17 per cent increase in passengers last year compared to 2016. “To keep pace with this growth, the Directorate General of Civil Aviation (DGCA) has also revamped the existing airport through a number of projects such as the construction of the new passenger terminal (T2) with a capacity of 25 million passengers annually, scheduled to complete by 2022,” he said.

Sheikh Salman added that the DGCA has also started building a new passenger support terminal (T4), work on which is proceeding according to schedule.

Korea’s Incheon International Airport Corporation (IIAC) has been appointed to operate and manage T4, which is set to start operations within the next three months. It has 14 gates and has been designed to handle 4.5 million passengers per year.

The DGCA is also setting up two new runways and a new control tower at the airport.

According to Sheikh Salman, work is under way on the first stage of a new cargo city at Kuwait airport which will be built on an area of 3 million sq m and is expected to be the largest in the Middle East.

Meanwhile, work is in progress on the new passenger terminal (T2), after Turkey-based Limak Holding and local construction firm Kharafi National jointly won the KD1.312 billion contract for the project.

Spanning 708,000 sq m, the terminal is designed to accommodate all aircraft types through 51 gates and stands. The project, designed by Fosters + Partners, is slated to be completed in six years.

Kuwait airport last month launched operations at a dedicated passenger terminal for the local airlines Jazeera Airways, which was built under an investment of KD14 million.

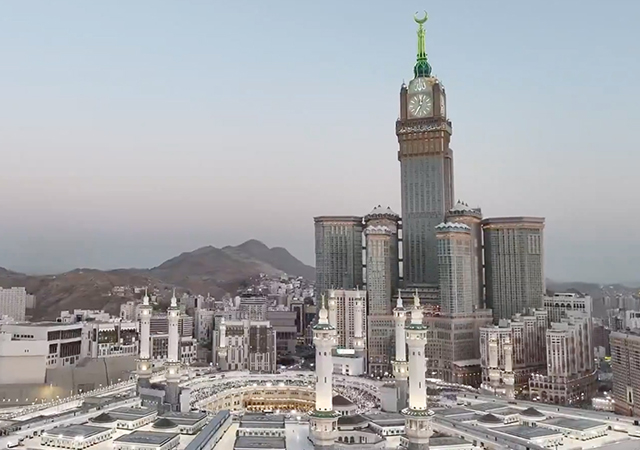

In the ports sector, work is under way on the $16-billion Mubarak Al Kabeer Port at Bubiyan Island and is set to be completed by late 2019. The project is expected to go a long way in establishing Kuwait as a regional trading and logistics hub.

Roads & Bridges

|

The Mubarak Al Kabeer Port at Bubiyan Island ... a key development in the transport sector. |

According to BMI Research, 24 per cent of projects currently under construction in the transport sector are in the roads and bridges segment. There are about $5.5 billion of road construction works that are either under way or in planning, it adds.

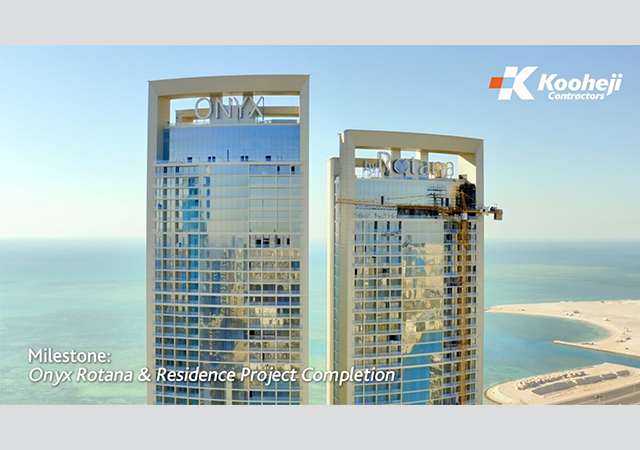

The most prominent in this sector is the $3-billion Sheikh Jaber Al Ahmad Al Sabah Causeway, which on completion will be one of the world’s longest bridges. The entire causeway project consists of two parts: the main causeway linking Shuwaikh Port and the Subiya area to the north and the Doha Link, which will connect the port with the Doha motorway (see Page 50).

Meanwhile, some 80 projects, with a budget of KD500 million, are planned to facilitate traffic in coming years, according to Ahmad Al Hesan, the director general of the Roads Authority and Land Transports.

Housing

|

|

The Hessah Towers in the Hessah Al Mubarak District ... 40 floors of duplexes, townhouses and apartments. |

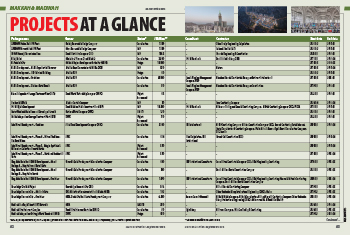

Major housing developments are under way at Jaber Al Ahmad and Mutlaa cities, which are estimated to cost KD388 million, as well as at the South Abdullah Al Mubarak project.

Early this year, the Public Authority for Housing Welfare (PAHW) awarded a contract to Limak Holding to construct 3,260 housing units and power stations at the South Abdullah Al Mubarak housing project.

According to PAHW data, Kuwait spent KD911.3 million on new housing projects last year.

Real Estate

Among the mega real estate projects announced this year are the Hessah Towers by United Real Estate Company (URC) and the KD250-million Al Khiran Project, The New Pulse of Kuwait by the Tamdeen Group.

Hessah Towers, which comprises two 40-storey towers with a total of 212 units, will be built in the upcoming exclusive Hessah Al Mubarak District along the Arabian Gulf Road. UREC will develop 40 per cent of the Hessah Al Mubarak District under Mena Homes, an affiliate of URC.

The Al Khiran Project, located in Sabah Al Ahmad Sea City, marked its ground-breaking last month. To be completed in two phases, the project will be the largest waterfront recreational tourism destination built by the private sector in Kuwait.

Among other projects, the Tamdeen Group opened the Al Kout Mall to the public last April as the latest addition to Al Kout, a mega waterfront retail and leisure destination.

Meanwhile, Kuwait’s iconic The Avenues mall marked the grand opening of its fourth phase expansion in March.

.jpg)