The huge global need to develop infrastructure is giving rise to a massive infrastructure investment deficit, especially in emerging markets and developing economies (EMDEs). Against this backdrop, many countries are tapping into private capital for introducing projects.

Public-private partnerships (PPP) offer significant opportunities for governments to bring in efficiency into the public sector. Sectors that have been traditionally held by the public sector, such as power, telecommunications and health, can now be delivered through PPP models. If properly implemented, PPPs can offer significant service improvements, and thus offer value for money to the tax payers.

The biggest benefit of PPP projects, in many emerging markets, is the ability to tap into private capital to deliver goods and services that are public in nature. These countries are often constrained by their fiscal ability to develop necessary infrastructure projects in tandem with the population growth. PPPs allow them to tap into private capital to develop projects and deliver services in a more efficient way.

It must be understood that PPP projects are capital intensive in nature, requiring large-scale funding to construct. The spur of PPP projects in many countries started in the early 1990s when international and regional banks, including development financial institutions started big-ticket lending for infrastructure development.

To pave the way, those countries went through a number of policy and regulatory changes, making them conducive for PPP investments. Overwhelmed by these success stories and driven by the dire necessity of providing essential public goods and services to the people, governments of many developing countries started designing large-scale infrastructure projects in PPP fashion.

A project worth mentioning is the Konya PPP hospital project in Turkey. The Government of Turkey launched a comprehensive transformation/restructuring programme of its healthcare system approximately 12 years ago, with the aim of providing citizens with comprehensive and quality healthcare services. Under the programme, the government intends to capitalise on the private sector’s investment capabilities and experience in healthcare services to meet the significant capital expenditure necessary to implement the programme. Turkey aims to develop 35 new integrated PPP health campuses.

The Konya PPP hospital project is the first PPP hospital financing in Turkey that successfully used Islamic finance. Those providing funding to this project alongside the Islamic Development Bank include the European Bank for Reconstruction and Development, and Black Sea Trade Development Bank.

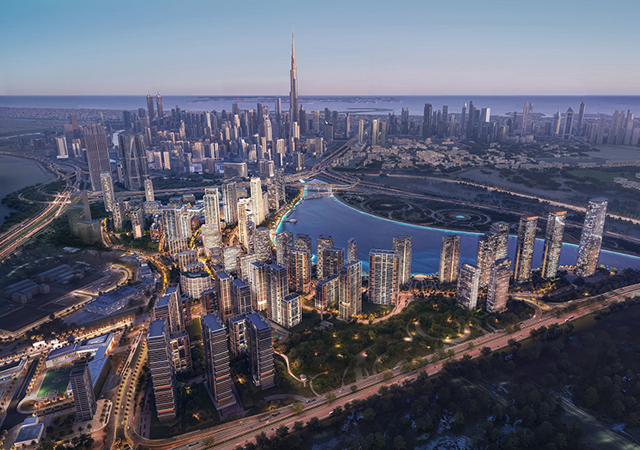

The GCC countries have been exploring PPPs for many years and have been particularly successful in the energy and water co-generation sector. Countries such as Saudi Arabia, UAE, Oman and Qatar have established a track record of independent water and power projects. For many years, all of these countries were on a high growth trajectory, fuelled by massive construction activities. And with a growing population, the demand for power and water is always on the rise. On the other hand, falling oil prices caused a strain on many of these countries to deliver infrastructure projects – giving even more reason to resort to PPPs.

Challenges

With opportunities, there come challenges. Two challenges particularly seen while implementing PPP projects are a lack of financing and public-sector capacity.

In terms of the first challenge, traditional financing sources are not enough to support the need for scaling up PPP needs. Practitioners around the world are increasingly looking for innovative solutions to bring in more financing into infrastructure development. The World Bank Group and other multilateral organisations have been working tirelessly to bring in more private capital towards infrastructure development. This remains a significant challenge.

The other challenge is the capacity of the public sector to deal with PPP projects. There is a dearth of bankable PPP projects in the market and a common cited cause is the capacity constraint of public sector entities to develop bankable PPP projects. Examples are abundant where projects have not progressed to reality, either failing to attract interested sponsors, or despite getting sponsors, being unable to entice the lending community. A failed PPP initiative leaves behind multiple impacts, such as failure to deliver an essential service to people, enormous loss of time and resources invested by public and private entities and weakening the perception of the investment climate of a country among private investors, to name a few.

Risks

Optimal risk sharing is key to successful PPPs, not only in the Middle East and North Africa (Mena) region, but globally.

There is a misperceived idea amongst public officials involved in PPP initiatives in many developing countries that PPP is a private-sector-driven initiative, and so the private investor should assume most of the risks. This creates a tendency of shifting as much risks as possible to private investors, without much consideration on whether the private investors can actually manage those risks.

The fundamental principle that governs a win-win risk-sharing protocol is to allocate risks to the parties who are best able to handle it. For example, a private investor cannot mitigate risks stemming from macroeconomic issues, such as exchange rate fluctuations, inflation and the like. Similarly, public entities are not supposed to take the risk of a poor operating performance of a PPP project, since it is the private investor who is tasked with running the PPP project.

Managing external risks is a challenging task for PPP projects. With external risks, most of the time practitioners refer to uncertainties that are beyond the control of a PPP project itself, but affect the economics of the project. These risks can manifest through fluctuations in price and/or demand of the service or goods the project is offering and the cost of delivering those.

External risks are difficult to hedge against and this is a challenge for a PPP project that relies on direct cost recovery method for its sustainability. In most of the cases, the solution is in the project’s contractual design for risk allocations, predominantly through off-taker agreements.

In many countries, for example, the off-takers are either state-owned entities (SOEs), government parastatals or quasi-government. The financials of many of these entities are not strong enough to support a long-term financial commitment for PPP projects. These entities rely heavily on support from the central government or line ministry. Unless the off-take agreement is backed by a guarantee from the government or line ministry, there remains the chance that the project might not become bankable.

Leadership

There are two main categories of leadership when it comes to implementing PPPs: political and executive. Political leadership needs to focus on ensuring value for money and as such, selection of projects that yield the highest value for money for the stakeholders. Continuous political support for a PPP programme at the country level is also important for a sustainable PPP journey.

It’s important to understand that the lifecycle of infrastructure projects is way longer than the political lifecycle. And so selection of the right projects and continuing to support those projects are important.

For executive leadership, there is a need to build up capacity to prepare bankable PPP projects. Executive leaderships of different line ministries should focus on developing their internal capacity to deal with PPP projects.

Conclusion

Setting up a dedicated PPP centre brings together the necessary skills to deal with PPP policies and projects across various sectors of the country. A well-designed PPP project in a sound policy context makes it easy to attract investors and lenders alike.

* Fida Rana is a PPP consultant to the World Bank’s Infrastructure and PPP team. He is a leading infrastructure finance and PPP expert with more than 18 years of international experiences covering Asia, Africa, the Middle East and Central Asia. .

Rana is a regular speaker in international conferences and workshops on PPP and infrastructure finance. He has written extensively on infrastructure finance and PPPs.

This article is based on his interview with Management Events for the event, Mena PPP: Anchoring Solid Partnerships event, held in Dubai, UAE, on September 17–18.