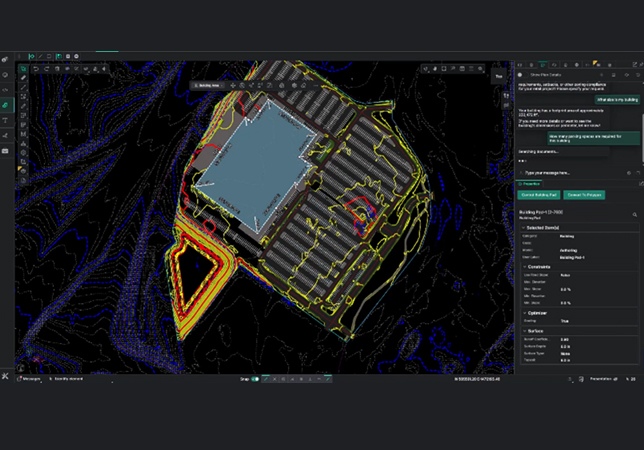

The Dubai Chamber building

The Dubai Chamber building

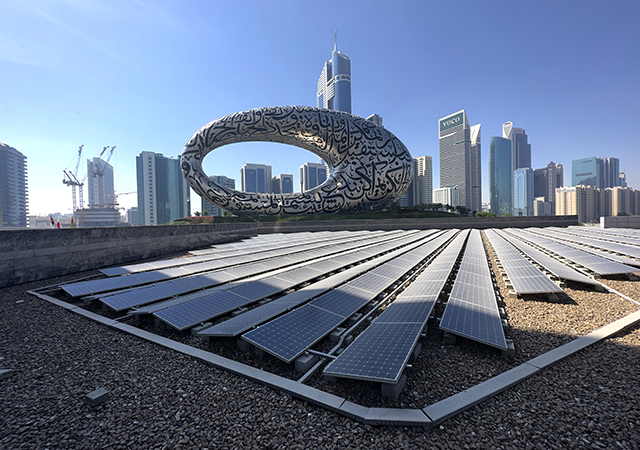

The Dubai Chamber of Commerce Sustainability Week 2022 saw strong engagement and attendance from over 113,600 employees across 330 companies from government, academic institutions as well as non-profit organisations.

With the aim to improve Dubai’s favourable business environment, the event held under the theme “Engaging Stakeholders in Sustainability, Improve Relevance, Ensure Priority, Enhance Impact” raised awareness about the importance of involving and engaging stakeholders in the business sustainability journey.

Over a series of roundtable dialogues and panel discussions, the event shared valuable insights on stakeholder management techniques and strategies as well as solutions to achieving sustainability objectives.

B2B stakeholder engagement

This year, the Sustainability Week Exhibition focused on local sustainable initiatives and businesses serving as an excellent forum for B2B stakeholder engagement of sustainable suppliers.

A campaign entitled Let’s Engage Stakeholders in Sustainability, was organised as part of the Sustainability Week. It saw more than 177 projects, activities and events focused on stakeholder engagement, attracting an overwhelming participation from local businesses. The results of the campaign were unveiled at the closing ceremony.

Dr Kamel Mellahi, Senior Manager, Dubai Chamber of Commerce Centre for Responsible Business said, the strong participation in Sustainability Week 2022 reflects the commitment of top-notch sustainability leaders from the Dubai business community and abroad who have offered valuable insights during the week on what can be done to improve stakeholder engagement in businesses, adding that it will bring a significant impact on best practices in Dubai.

Dr Mellahi added: “The week-long initiative and campaign achieved its objectives of raising awareness on the benefits of prioritising different stakeholders and encouraging organisations to take practical actions and further their progress in this area.”-- TradeArabia News Service

.jpg)

.jpg)

.jpg)