The regional construction sector would hold greater opportunities for the digitisation and revitalisation of built assets, as well as adaptive modular design as a construction tool, following 2018’s slowdown in construction activities attributed to reduced oil prices and subsequent cuts to project spending across the region in 2018, said International construction and real estate consultancy Drees & Sommer.

With 3,200 employees in 40 locations globally, Drees & Sommer has been supporting private and public clients and investors for almost 50 years in all aspects of real estate and infrastructure.

As per the company's predictions, there will be an increased momentum in the Mideast construction sector mainly driven by government support through long-term economic diversification plans, including Abu Dhabi Vision 2030 and Saudi Vision 2030.

The consultancy believes these agendas will develop fundamental sectors including hospitality, healthcare and infrastructure, while tourism and gradually stabilising oil prices will contribute to higher capital spend on construction projects in the region over the coming year.

Currently, Saudi Arabia and the UAE remain the largest regional markets and are expected to award construction contracts valued at over $320 billion over the next twelve months,. said the expert.

In addition, there is currently over $3 trillion worth of projects in the pipeline for the regional construction sector over the next decade, according to Deloitte Middle East, during 2018’s Leaders in Construction Summit.

Stephan Degenhart, the associate partner at Drees & Sommer and managing director of the Middle East office, said: "Although the real changes will happen over the next 10 years, higher capital spend in 2019 on construction projects throughout the region will likely draw an increased focus on ROI for developers and investors."

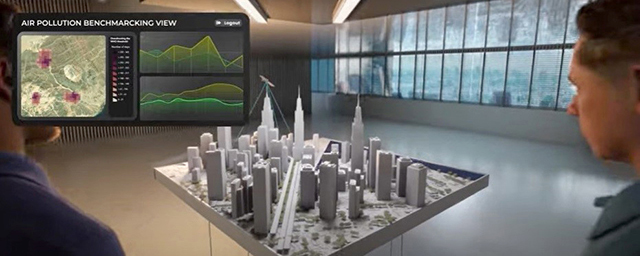

"Adaptive modular design and digitization at planning stage and revitalization at operation phase are the frontrunners to enable increased ROI. The Middle East’s construction industry is currently far less digitally developed than those in other parts of the world, presenting a key opportunity for growth," he stated.

"Greater attention will be given to projects throughout the three stages of the construction process: planning, build and operations, with particular emphasis on early adoption in the planning stage or even phase zero. This will provide greater opportunity for the integration of digitalised adaptive modular solutions to ensure longevity, flexibility and ROI," observed Degenhart.

Key digital trends such as 3D printing, 3D laser scanning, digital pre-fabrication and continuous advances in Building Information Modeling (BIM) will begin to make more of an appearance within the regional construction sector as it continues to develop and shift in focus towards a more digital future, he added.

Degenhart pointed out that BIM was a good example of a smart system already becoming a mandate for some construction companies and developers, such as CCC and Emaar, while more companies are expected to enforce similar policies over the coming year.

Markets such as the UAE and Saudi Arabia, which aim to further develop economic sectors including tourism and hospitality, will have different requirements to markets like Egypt and Oman, whose economic diversification agendas focus more on transport and infrastructure," he said.

Greater upfront capital investment, he stated, will lower the need for cost-cutting as Drees & Sommer expects to see opportunities for longer lifecycles for buildings to become more of a priority, with higher-quality and smart materials being implemented.

These shifts will contribute to more sustainable solutions and align with various governmental initiatives such as Expo 2020 Dubai, Saudi Vision 2030 and Dubai Clean Energy Strategy 2050.

Filippo Sona, the managing director, Global Hospitality at Drees & Sommer, said: "The GCC hospitality sector is currently going through a period of stabilisation, with occupancy levels remaining strong and average room rates unchanged year on year."

"Despite the hospitality sector already generating a healthy volume of business, hotels will need to develop strategies to become more efficient and stand out if they want to remain profitable and achieve better ROI," he added.

“As certain markets place greater emphasis on developing their hospitality sectors, there will be higher demand from investors to create smart buildings that are more adaptable to user needs. Smarter engineering designs have provided new means of increasing ROI and market attractiveness, through a range of user-centric and energy-saving features such as smart parking and automated lighting and air-conditioning.”

Locally, the hospitality sector is likely to see more opportunities for Revitalization projects, as 67 per cent of hotels in Dubai were constructed over a decade ago and are nearing the end of their expected lifecycles, according to Sona.

Ageing hotels will face a need to refurbish in order to cope with new market supply and become better equipped to attract an increasingly price-sensitive audience.

Abdulmajid Karanouh, International Director, Head of Interdisciplinary Design & Innovation at Drees & Sommer, said: “Drees & Sommer will deliver a number of projects throughout the Middle East in 2019, that will incorporate the latest digital construction techniques."

"We are currently consulting on the North Souks in Central Beirut District, designed by Zaha Hadid Architects, where digital design and adaptive digital fabrication were key to the development and delivery of this highly complex and iconic building," noted Karanouh.

"We will continue to provide our clients with high-level engineering and consultancy services while at the same time reinforcing research and development efforts in interdisciplinary design engineering and advanced materials and construction to help streamline the uptake of Digitization in the region," he added.

Degenhart said although higher capital expenditure on construction projects throughout the region means greater opportunities for digital transformation, the main challenge for the sector would be training those at operational level and altering the traditional processes currently being used as the norm.-TradeArabia News Service

_0001.jpg)

.jpg)

.jpg)

.jpg)