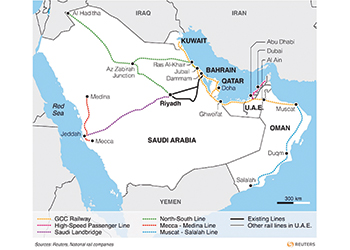

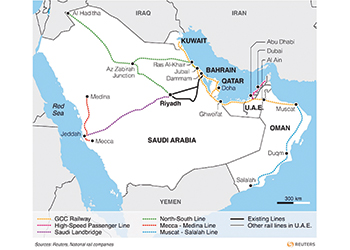

The proposed GCC-wide railway network.

The proposed GCC-wide railway network.

The GCC rail network has been hit by a series of delays, exacerbated by a steep fall in oil revenues. However, the region agrees that it needs to move ahead with plans, writes ABDULAZIZ KHATTAK.

Despite doubts looming over meeting the 2018 deadline set for the completion of the GCC rail network – with some member states terming the deadline unrealistic – the region remains determined to be linked through a common network.

The 2,100-km passenger and freight railway costing $15.4 billion, including the cost of two new causeways, will run from Kuwait down the Gulf coast and through the UAE to Oman, with lines connecting to Qatar, Bahrain and Saudi Arabia’s interior and the Red Sea coast.

The project has suffered technical and bureaucratic delays since its announcement last decade, with the completion date having already been delayed from 2017 to a year later – with even this deadline now seeming unachievable.

The multibillion-dollar GCC superfast network – which would enable passengers to travel from Doha to Kuwait within two hours at speeds of up to 350 kmph – may take between six and eight years to construct, once work starts.

According to Abdulla Al Nuaimi, UAE Minister of Infrastructure Development and chairman of the Federal Transport Authority, “2018 is not realistic”.

While the GCC network would connect each country in the region, it has also called for each member state to press ahead with plans to connect its interior areas. This has spawned the urge to develop a diverse network comprising railways, metros, and tramways in each country of the region – unleashing ample opportunities in the railways sector.

According to a report released ahead of the Middle East Rail 2016 conference held in Dubai, UAE, in March (8 and 9), some 16 major railway projects worth a whopping $352 billion are currently under way in the Middle East. While, many of these projects are not under way, a slump in oil prices has dragged the finances of governments in the region into deficit, prompting them to slow construction plans in some areas that would link up with the GCC network.

In January, state-backed Etihad Rail suspended a tender to build the 628-km Phase Two of a rail network within the UAE. This would have extended an existing 264-km line transporting sulphur from Abu Dhabi’s interior to the coastal industrial city of Ruwais, as well as to the Saudi and Oman borders and other parts of the UAE including downtown Dubai and Abu Dhabi.

Oman’s transport minister in turn indicated that his country may change its railway plans to facilitate Oman’s seaborne exports, rather than using its trains to distribute imports via the Gulf network.

Bahrain

Plans for Bahrain’s proposed light rail network, which is expected to have four lines covering 105 km, are still in the initial stages, according to Mariam Jumaan, Transportation and Telecommunications Ministry land transportation under-secretary.

The first phase will cover a 25-km line with 17 train stations linking financial districts, residential areas and shopping centres and will start at the soon-to-be constructed King Hamad Causeway.

Work on the King Hamad Causeway project, which will have a rail link as well, has been effectively started by the Saudis, according to Saudi Ambassador to Bahrain Dr Abdulla Al Shaikh. It is estimated to cost $15.5 billion.

Kuwait

Kuwait has been making progress in clearing the route of the proposed lines for its railway project, according to Minister of Public Works and Minister of State for National Assembly Affairs Ali Al Omair.

Moves are being made to compensate owners of land areas to be acquired along the route of the rail. The project is likely to be implemented as a public-private partnership (PPP) and hence clearing these obstacles would make it easier to find an investor for the project, he indicates.

The country also has plans for a $7-billion metro system which would have 160 km of rail lines and 68 stations – 60 per cent of which will be underground.

|

Hesan Al Khaleej ... a concept tailored by Siemens for a high-speed intercity train in the Gulf. |

Oman

Oman has reportedly decided to delay its rail project connecting the sultanate with the rest of the Gulf countries and may rather focus on building a domestic rail network, because of uncertainty over when the regional project will go ahead, according to Transport Minister Ahmed bin Mohammed Al Futaisi.

Futaisi says the suspension of Etihad’s plan made it difficult for Oman to award a contract for its own track, even though Muscat was ahead of other countries in designing its part of the network.

According to Oman Rail’s chief commercial officer John Lesniewski the rail project is on track and the first line is expected to be operational in four years.

According to Mohammed Al Shuaili, director of the Minister of Transport and Communications Office, a contract with a private consultancy to manage the rail project has also been cancelled to “avoid extra costs” but he insists that the project itself has not been cancelled, said a Times of Oman report. A consortium led by Spain’s Tecnicas Reunidas secured a $149-million contract for project management consultancy on the 207-km first phase of the 2,135-km Oman network in February 2015.

Qatar

Qatar Railways Company (Qatar Rail) is working on three networks – Doha Metro, Lusail Tram and the long-distance rail – which will be part of a unified and integrated transport network covering different parts of Qatar, key aspects of which are expected to be completed before the 2022 Fifa World Cup that the country is hosting.

Doha Metro, Qatar’s largest infrastructure project, stretches over a 215-km network with up to 100 stations. Costing $36 billion, it is being built over two phases and will include four lines. The first phase will cover 80 km across Doha, of which 63 km is underground. This phase will see the Red, Gold and Green Lines opening in 2019 with 37 stations – with Msheireb metro station being the main interchange connecting the three lines (see separate article).

More than 60 per cent of the work including 113 km of tunnelling on the Doha Metro has already been completed by Qatar Rail, according to the English daily Peninsula.

In early April, Qatar Rail completed tunnelling on the Green Line with tunnelling works on both the Gold and Red lines to be completed later this year. Towards the year-end, Qatar Rail expects to move from construction into systems installation when track, power supply and signalling will begin to be installed.

Among other developments, Qatar Rail last month (May) dismissed “on solid contractual grounds” an international consortium that had won the $1.4-billion design-and-build contract for the Msheireb and Education City stations in June 2013 and swiftly appointed Consolidated Contractors Group to take over the project.

Other contracts a major deal to Kone to supply elevators and escalators for the Doha Metro project. It includes the supply of over 500 pieces of equipment for the Red Line South and Gold Line and a 20-year maintenance agreement.

Meanwhile, Qatar Rail last month awarded a $41.6-million contract to a joint venture of Hill International, Italferr and Astad Engineering Consultancy and Project Management Company to provide project management consultancy services for the Lusail Light Rail Transit (LLRT) system. The 38.5-km tram system will have four lines, 25 stations at-grade and seven underground stations.

The railway authority also unveiled in April the designs for the future Doha Metro cars and Lusail Light Rail Transit vehicles, which combine Qatari heritage and culture with modern technology.

Saudi Arabia

While many projects in the kingdom have suffered delays due to the oil price slump, work on the $22.5-billion urban rail and bus system for the congested Saudi Arabian capital is reported to be on track.

Construction on the Riyadh Metro, which began in late 2013, is targeted for completion by the end of 2018. Part of the transportation programme for Riyadh, it is the biggest infrastructure project in the history of the Saudi capital and one of the largest metros in the world.

Last month, Arriyadh Development Authority (ADA) marked the end of the excavation for a metro tunnel for what will be Malaz station in south Riyadh. One-third of the metro is now complete.

Three foreign consortiums are building the metro, the six lines of which will cover 176 km, supported by a bus network of 1,150 km. About 40 per cent of the system will be underground.

FAST Consortium is one of three consortiums contracted by the ADA to design and build the metro project. It is led by Spanish construction group FCC and includes partners Korean Samsung C&T, French company Alstom, Strukton of the Netherlands, Freyssinet Saudi Arabia, Atkins of the UK, Typsa of Spain and Setec of France. FAST is responsible to deliver the Yellow, Green, and Purple lines (lines Four, Five and Six) of the project, totalling 64 km.

The other two consortiums include BACS, which is building lines One and Two; and ArRiyadh New Mobility (ANM) undertaking Line Three.

Other metro projects in Makkah, Madinah and Jeddah are in various stages of execution. Last month, Ali Abdelfattah, chief executive-designate of the Saudi government’s Makkah Mass Rail Transit (MMRT), said that the $16.5-billion metro for Makkah has been delayed so that its financing can be restructured, but later retracted his statements saying the project was on track.

The 95-km Madinah metro is slated to become operational in 2020 and currently a consortium comprising Egis and Systra is conducting design studies for the network. Meanwhile, the $12-billion Jeddah Metro, also scheduled for completion in 2020, is in the early design stages.

Among other projects, the completion date for the Haramain High Speed Rail line has been put back by a further 14 months, from January 2017 to the first quarter of 2018. Railway systems and rolling stock for the 450-km Makkah-Jeddah-Madinah line are being supplied under a €6.7 billion ($7.6 billion) contract which was awarded in October 2011 to the AlShoula Consortium of two Saudi and 12 Spanish companies, including Renfe, Adif and rolling stock supplier Talgo.

The opening had been envisaged for 2014, however, the project has faced difficulties including allegations of delays to the completion of the civil works which are being undertaken under separate contracts, windblown sand in the inhospitable climate and disputes within the consortium.

Another project on the anvil is the construction of the much-awaited Saudi Landbridge, a 480-km high-speed railway line between Riyadh and Dammam.

UAE

Etihad Rail, the developer and operator of the UAE’s $11-billion national rail network in January suspended the tendering process for Stage Two of the project which involves linking the country to the Saudi border at Ghweifat and the Omani border at Al Ain, and also vital areas such as Mussaffah, Khalifa Port and Jebel Ali Port in Dubai.

According to Nasser Alsowaidi, chairman of Etihad Rail, the decision will have no impact on Stage One operations. Commercial operations on Stage One, which links Shah and Habshan to the port of Ruwais, commenced in December 2015.

To date, Etihad Rail has transported four million tonnes of sulphur from Shah and Habshan to the port of Ruwais for the Abu Dhabi National Oil Company (Adnoc). Once Stage One reaches full commercial capacity, Etihad Rail will transport more than seven million tonnes of sulphur every year.

The UAE has completed 246 km of its total 684 km section of the GCC rail network.

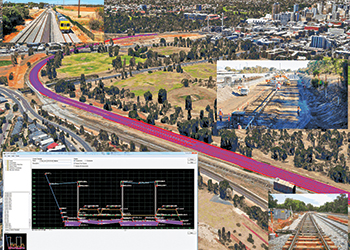

_0001.jpg)

.jpg)

.jpg)

.jpg)