Oman residential rental market ‘under pressure’

Oman’s residential rental market continued to be under pressure during Q1 2016 as companies are trying to adjust to the market conditions and minimise expenses by reducing headcount and housing allowances, according to leading consultancy house PKF.

Based on third-party reports, due to the slowing economic growth, demand for rented accommodation and particularly larger housing units has decreased, resulting in a 12.7 per cent year-on-year (y-o-y) decline in average residential rents during the first quarter, it states.

Over the last couple of years, a large supply of new quality apartments has penetrated the residential market in Muscat, which, however, was absorbed quickly due to a sustained growth in the expat population and increasing demand for smaller-sized units.

As a result, vacancy rates across the villa segment increased, leading to a 14.1 per cent y-o-y decline in average monthly villa lease rates, said PKF.

With regards to the residential sales market in Oman, the prevailing regional economic uncertainty and the decline in disposable household income levels have resulted in vendors decreasing property sales rates to entice demand from potential buyers. As a result, the number of sales contracts during Q1 increased slightly by 0.3 per cent to 20,963, when compared to the same quarter in 2015 according to the National Centre for Statistics and Information, it adds.

Despite the increase in transactional activity, the total traded value of property in the sultanate amounted to RO922.1 million ($2.38 billion) in Q1, representing a y-o-y decline of 30.3 per cent. The quarter also saw a 39.5 per cent fall in the number of properties issued for GCC nationals.

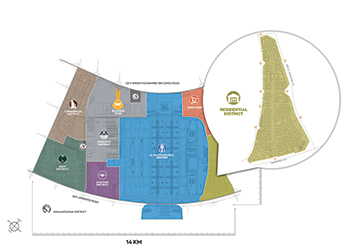

Oman’s integrated tourism complexes (ITC) and more specifically Al Mouj and Muscat Hills continued to register high occupancy rates, as ITC developments remain the only places in the country where non-GCC nationals are permitted to own a property.

The first quarter witnessed the launch of ‘The Boulevard’ project in Muscat Hills “a pedestrian-only 665-m-long street that boasts shopping, dining and leisure outlets, which is due for completion in 2018,” states the consultancy house.

Abu Dhabi real estate market suffers decline

The real estate market in Abu Dhabi, UAE, saw a minor decline during the second quarter in most sectors for the first time in three years, says a report.

While supply is under control, reduced demand from the contraction of the oil sector and lower government spending has started to affect real estate markets, says the JLL Abu Dhabi Real Estate Market Overview.

The future outlook is largely dependent on the return of government spending, it says.

The residential market started to face downward pressure with vacancy rates increasing and rents and sale prices beginning to decline. With increasing job cuts and reducing disposal incomes, vacancy rates are set to rise, further impacting rents and prices in the second half of the year, it adds.

Downsizing in the oil and government sectors has continued throughout Q2 following the decline in oil prices and government spending, impacting the office market. As a result, demand has reduced, with office rents declining three per cent quarter-on-quarter.

Despite the reduction in retail spending, retail rents remained stable this quarter. Vacancies remain minimal within regional and super-regional malls, says the report.

The hospitality market registered a 13 per cent year-on-year drop in ADRs (average daily rates), as the decline in corporate demand triggered by lower oil prices has continued throughout Q2 2016. Occupancy rates have been more stable, it says.

Al Jaber to raise $1.6bn from asset sale

Al Jaber Group, a family-owned business in Abu Dhabi, UAE, has almost doubled the amount of cash it intends to raise from asset sales including real estate and shares under a new debt repayment plan it offered to creditors, two sources with knowledge of the matter say.

The group, with interests spanning construction, engineering and shipping, plans to raise Dh5.2 billion ($1.4 billion) by selling assets including real estate and shares by March 2018, compared with Dh2.75 billion ($748 million) proposed earlier, the sources told Bloomberg, asking not to be identified because the information is private.

Al Jaber will now need to get an additional Dh3.9 billion ($1.06 billion) after already raising Dh1.3 billion ($353 million) from previous sales, it said in its presentation to creditors last month, according to the sources.

Al Jaber is among several UAE businesses that sought to restructure liabilities after the global financial crisis in 2008 led to a crash in property prices.

The new plan includes raising Dh1.5 billion ($408 million) by the end of the year, Dh600 million ($163 million) of which will be used to repay debt and for working capital, the sources say.

The company will use an additional Dh650 million ($177 million) to repay creditors who want to exit at about 50 cents to dollar, and the maturity of the remaining debt would be extended to 2024, they say.

National Bank of Abu Dhabi, Abu Dhabi Commercial Bank, First Gulf Bank and Union National Bank, which hold about 50 per cent of Al Jaber’s $1.6 billion debt, agreed to the debt plan, say the sources.

Creditors had declined Al Jaber’s request earlier this year for a 12-month break in interest payments and had asked it to enhance asset sales to meet debt obligations.

_0001.jpg)

.jpg)

.jpg)

.jpg)