The Midfield Terminal Complex ... 20 million passengers capacity.

The Midfield Terminal Complex ... 20 million passengers capacity.

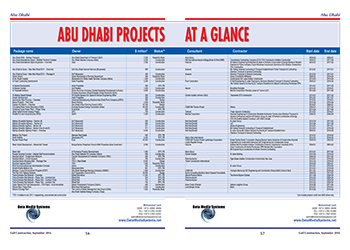

Real estate development and a tourism thrust is propelling construction activity in Abu Dhabi, which has been making commendable efforts at diversifying its efforts, says MRIDULA BHATTACHARYA.

Abu dhabi’s construction sector has remained stable over the past year, bolstered by projects that were launched by the UAE’s wealthiest emirate when oil prices were high. However the collapse in prices has brought about a slowdown in activity.

JLL, a leading global real estate investment and advisory firm, in its latest report on the residential, office, retail and hospitality sectors, says the real estate market in the emirate started showing initial signs of decline during Q2 2016 due to the slowdown in government spending.

Abu Dhabi, sitting on six per cent of the world’s oil reserves, slashed spending when crude prices plummeted to below $30 a barrel.

David Dudley, international director and head of Abu Dhabi office at JLL Mena, says: “During Q2 2016, we have started to see the first signs of a downward trend as the decline in the oil sector, reduced government spending and weak sentiment continues. And while supply remains stable, the reduction in demand has now started to cause vacancy rates to nudge upwards, indicating we have now reached a tipping point with rents declining for the first time in three years.”

|

|

|

The reduced oil price has resulted in a continued pause in government spending on economic diversification and infrastructure and job cuts in the government sector.Among the major projects that have suffered setbacks is Etihad Rail, where the tendering for Stage Two of the project was suspended earlier this year by the developer and operator. Stage Two involves the construction of a rail network in Abu Dhabi that will link the Saudi border at Ghweifat and the Omani border at Al Ain. Stage One of the rail network, which links Shah and Habshan to the port of Ruwais, launched operations in December last year.

Dudley continues: “The good news is that government remains committed to the 2030 Vision and has recently announced its priority projects to 2020. While we are going through a period of weak demand, growth continues from projects commenced while oil prices were high. New projects are in the pipeline and supply growth remains suppressed.”

Meanwhile, a Standard Chartered Bank report says it expects much lower growth in the emirate this year (at two per cent), reflecting the full-year effect of the government’s consolidation efforts in non-oil sectors including financial services and construction.

“The Abu Dhabi government has favoured front-loading fiscal adjustment,” the report says, noting the emirate cut expenditure by 20 per cent last year after hydrocarbon revenues declined 46 per cent last year.

“The introduction of a value-added tax in 2018 will diversify the economy’s revenue base away from hydrocarbon revenues. Abu Dhabi is targeting a further 17 per cent cut in spending this year,” it adds.

Meanwhile, the non-oil sectors are enhancing the economic growth of Abu Dhabi, according to a report by the Abu Dhabi Department of Economic Development (Added). The contribution of non-oil activities to Abu Dhabi’s GDP increased to 50.7 per cent in Q4 2015.

Ali Majid Al Mansouri, Added chairman, says: “The worst is behind us. Our budget is still strong. The majority of projects are still there and there are other smaller projects which are moving. The economy is moving.”

Infrastructure

The executive committee of the Executive Council recently approved a number of projects for roads, infrastructure, services, and education facilities worth Dh544 million ($148 million). These include roads and infrastructure projects at several plots in Mohammad Bin Zayed City; internal roads and infrastructure projects in Al Nahda military residential zone, Bani Yas and Al Shawamekh; the development of Sheikh Zayed bin Sultan Road from the Al Falah intersection to Qasr Al Bahr intersection; and Phase One of the project to develop the Ghuwaifat border crossing.

Meanwhile, work is in progress on the Dh2.1-billion ($571 million) Abu Dhabi-Dubai Highway project. The 62-km eight-lane expressway project, set for completion in the fourth quarter of 2017, is an extension of Mohammad Bin Zayed Road, which currently ends in the Seih Shuaib area at the Dubai-Abu Dhabi border. The road will help motorists heading to Sharjah and the Northern Emirates avoid traffic on Sheikh Zayed Road and other roads in Dubai.

|

|

Al Maryah Central ... scheduled for completion in 2018. |

Tourism

Among the major projects that will give an impetus to the tourism sector are the state-of-the-art Midfield Terminal Complex (MTC) being built at Abu Dhabi International Airport and the various initiatives being taken by the Tourism Development and Investment Company (TDIC), master developer of major tourism, cultural and residential destinations in Abu Dhabi.

Abu Dhabi Airports is undertaking a Dh10-billion ($2.72 billion) investment in the MTC at Abu Dhabi International Airport. Located between the airport’s two runways, the complex includes a full terminal building, known as the Midfield Terminal Building (MTB), as well as passenger and cargo facilities, duty-free shops and restaurants. The project is due for completion by next year-end.

According to JLL, the outlook for the hospitality sector remains positive. Amidst general spending cuts, there is increased evidence of the government continuing to invest in mega tourism projects, particularly on the flagship Yas and Saadiyat Islands.

Around 2,200 rooms are expected to enter the market by the year-end, with a significant share coming from large projects such as the Millennium Bab Al Qasr (677) and the Fairmont Marina (over 800 hotel and serviced apartments). Other planned completions include the Grand Hyatt, Gloria Downtown and Marriott hotels. Hotel room supply is expected to reach almost 26,000 rooms by the end of 2019.

TDIC is working on several projects, including the Louvre Abu Dhabi, expected to open this year-end or early next year. It will be the first of three museums set to open on Saadiyat Island, and will be followed by Zayed National Museum and Guggenheim Abu Dhabi.

TDIC is the developer of Saadiyat and Desert Islands – a heritage-based tourism destination composed of eight islands – Sir Bani Yas Island, the historical Dalma Island and the previously unexplored Discovery Islands.

Earlier this year, Miral and Warner Bros announced a Warner Bros themed destination on Yas Island. Located alongside the world’s first Ferrari-branded theme park Ferrari World Abu Dhabi, and the Emirati-themed mega water park Yas Waterworld, Warner Bros World Abu Dhabi will include the only Warner Bros-branded hotel alongside the immersive theme park. The first phase of the project, Warner Bros World Abu Dhabi, is set to open in 2018. Construction is under way and rides are in production.

.jpg) |

|

Hidd Al Saadiyat ... 7 km of waterfront. |

Real estate

TDIC has numerous projects under development at Saadiyat apart from the museums. Among such projects is Mamsha Al Saadiyat, the first residential development within the Saadiyat Cultural District. The project awarded in April this year is scheduled for delivery in Q2 2018 (see Saadiyat communities set to take shape).

Another major development is Saadiyat Lagoons, the largest district on the island, expected to become home to 29,000 residents. Work is in progress on the enabling works for Phase One of the district (see Saadiyat communities set to take shape).

TDIC has also awarded a $100-million (Dh370 million) construction contract to Al Jaber Building for Jawaher Saadiyat, another residential complex on the island. Located within the Saadiyat Beach District and overlooking the Saadiyat Beach Golf Club, Jawaher Saadiyat will feature 83 exclusive villas townhouses. The project will be delivered in 24 months.

Another key community development on the island is Hidd Al Saadiyat, which boasts 461 exclusive villas and covers nearly 1.5 million sq m of natural waterfront land. Hidd Al Saadiyat has started work on its marina construction, which is scheduled for completion in April 2017.

Also taking shape at Saadiyat is Park View, a mixed-use development by Bloom Properties, a Bloom Holding subsidiary. Park View will comprise two buildings – one residential and the other hotel apartments (see Contractors).

Bloom Properties earlier this year also unveiled Faya at Bloom Gardens located near Khalifa Park. Featuring 132 contemporary townhouses, Faya is the fourth phase of the masterplanned community (see Real Estate).

Meanwhile, Abu Dhabi developer Aldar Properties has a string of projects under way in the emirate.

It recently launched a Dh6-billion ($1.63 billion) golf and waterfront development at Yas Island, its largest project to date. Yas Acres will boast 1,315 villas which will be available for purchase by all nationalities. The project will offer residents access to the golf course and clubhouse, parks, and schools. Upon completion, it will be home to 15,000 residents.

Aldar has recently awarded contracts worth Dh440 million ($119 million) to National Projects and Construction (NPC) for Nareel Island, its masterplanned island community; and Al Merief, a community in Khalifa City.

Scheduled to be carried out over a 16-month period, work on both developments commenced in July and covers infrastructure, utilities and public areas, in addition to associated marina works for Nareel Island.

Other Aldar projects under way include West Yas, the developer’s first villa community on Yas Island, where piling, sewerage, utility, telecommunication and lighting works are almost complete. It is also working on Shams Meera, a mid-market development on Reem Island. Work on the closed canal and streetscape of Shams Abu Dhabi on Reem Island is also progressing well with backfilling in both the central park and marina now complete.

According to a Wam report, significant headway has also been made at several of its other projects including Al Hadeel, the latest residential community to complement Al Raha Beach’s existing luxury residences; and Ansam, an Andalusian-style apartment development on the west side of Yas Island.

Meanwhile, another mega development on Reem Island is Reem Mall, a $1-billion fashion, entertainment and dining destination in Abu Dhabi. Strategically located at the entrance of island, the mall is poised to take shape with Al Futtaim Carillion having recently named as the preferred tenderer for its construction (see Reem Mall poised to get off the ground).

Another major retail destination taking shape in the emirate is Al Maryah Central, a $1.5-billion development spread across 289,000 sq m, being developed by Gulf Related. Located on Al Maryah Island, the development will include a 214,000-sq-m shopping centre anchored by two US-based department stores, Bloomingdale’s and Macy’s.

The development, due to be completed in 2018, will also feature two towers: one with a five-star hotel and serviced apartments, and the other with luxury residences.

_0001.jpg)

.jpg)

.jpg)

.jpg)