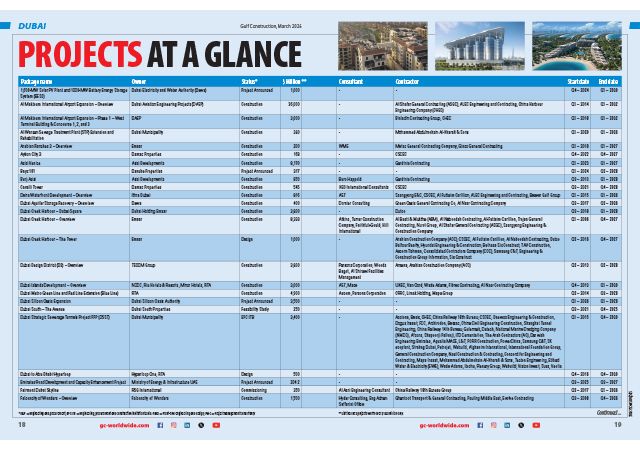

The global rush to construct data centres optimised for artificial intelligence (AI) workloads is raising alarms over the construction supply chain, with a new report revealing that more than 80 per cent of industry experts fear current capacity is inadequate to deliver the complex cooling technology required for the high-density facilities, according to professional services firm Turner & Townsend.

The firm’s 2025-2026 Data Centre Construction Cost Index highlights industry concerns over the transition from traditional cloud-based, air-cooled data centres to complex, high-density, liquid-cooled facilities needed to support AI workloads.

The survey of 280 data centre professionals across 52 markets found that 83 per cent do not believe supply chains are well-equipped to deliver the advanced cooling technology required for AI data centres.

In addition to cooling technology constraints, 48 per cent of respondents cited power availability as the most significant obstacle to timely project delivery, a concern amplified by the increasing power-density of AI infrastructure.

|

Coary ... region is emerging as a digital infrastructure powerhouse. |

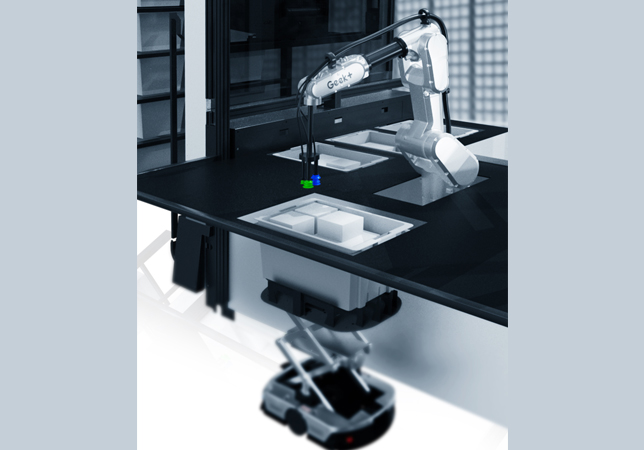

In hot climates such as that experience in Saudi Arabia, liquid cooling and direct-to-chip systems are essential for sustainability and performance.

Beyond the survey, the report’s cost index compares construction costs between global data centre markets. The Middle East remains cost-competitive globally, with Saudi Arabia at $11.3 per watt (ranking 18th globally) and UAE at $9.2 per watt (46th), compared to the two most expensive locations, Tokyo and Singapore at $15.2 and $14.5 per watt, respectively.

The Middle East is becoming a global hub for digital infrastructure, with data centre capacity set to surge from 1.2 GW in 2025 to 3.3 GW by 2030. Growth is fuelled by hyperscale demand, stronger regulations, rising investment, and the rapid expansion of AI workloads.

Alan Coary, Data Centre Lead, Middle East, at Turner & Townsend, says: “The Middle East is emerging as a global digital infrastructure powerhouse, with data centres driving ambitions in AI, cloud and digital sovereignty. Capacity is set to triple by 2030, fuelled by hyperscale demand and rapid growth of AI workloads.”

“Saudi Arabia and the UAE are driving this transformation with government-led initiatives and robust regulatory frameworks accelerating expansion. The kingdom is targeting 6.6 GW of AI computing capacity by 2034, reflecting its national vision for technological leadership. Meanwhile, the UAE is raising the bar with pioneering developments like Moro Hub’s solar-powered data centre and Stargate UAE, a flagship initiative in Abu Dhabi.

“As the region continues to grow, data centres have become strategic assets, accelerating digital transformation and positioning the Middle East as a global leader in digital infrastructure and innovation,” he adds.

Major projects in the region include Khazna’s rollout of AI-ready facilities, du’s hyperscale data centre in the UAE, and HUMAIN’s plan, backed by Saudi Arabia’s Public Investment Fund (PIF), to add 1.9 GW of capacity by 2030.

However, inflation of five per cent in Riyadh, Dubai, and Abu Dhabi for 2025 has signalled growing pressure on budgets as demand accelerates. Regional cost escalation continues to be driven by labour shortages, supply chain constraints, and rising demand.

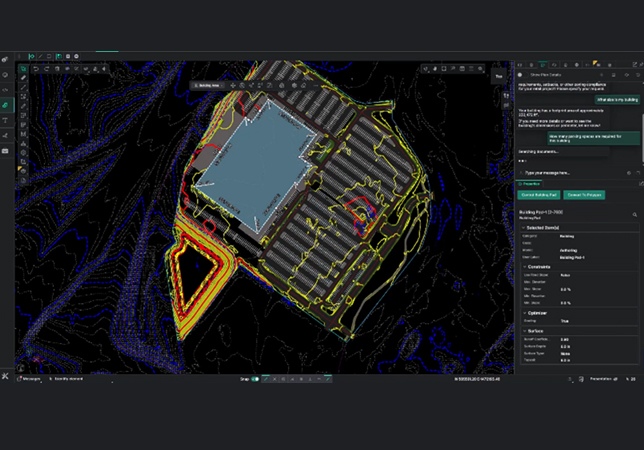

While inflation is due to reduce in 2026, developers are encouraged to adopt modular construction, local sourcing, and phased development to maintain cost efficiency and accelerate time to market. Turner & Townsend also advises clients to explore off-grid solutions, renewable integration, and battery storage to mitigate risks and align with environmental goals.

Globally, construction costs for traditional cloud-based data centres have stabilised, averaging 5.5 per cent in 2025, a sizeable drop from the 9.0 per cent year-on-year increase reported in 2024.

Notably, Turner & Townsend has identified a seven to 10 per cent cost premium between traditional and AI-ready data centres by comparing projects of similar IT capacity, underscoring the impact of advanced technical requirements (based on US data). n