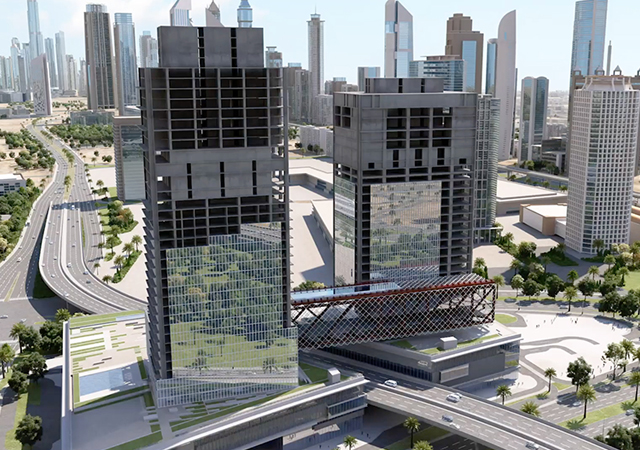

Alec Holdings, a diversified engineering and construction group in UAE, has announced its listing on Dubai Financial Market, thus marking UAE’s largest-ever initial public offering in the construction sector, by both valuation and size, and the first in the sector in over 15 years.

The company’s successful debut on the DFM follows the completion of a fully subscribed IPO, which raised AED1.4 billion ($381 million) through the sale of 1 billion existing ordinary shares by the selling shareholder, the Investment Corporation of Dubai (ICD), the principal investment arm of the Government of Dubai.

According to DFM, the offering represented 20% of the company’s issued share capital. Following the listing, the Investment Corporation of Dubai (ICD), Alec’s sole selling shareholder, will retain an 80% stake in the company.

Announcing the successful listing, Alec Holdings said the IPO was priced at AED1.4 per share, at the top end of the announced price range, implying a market capitalisation of AED7 billion ($1.91 billion) at listing.

The offering attracted strong demand from a diverse base of regional and international investors, generating total subscriptions of approximately AED30 billion ($8.1 billion) and an oversubscription level of more than 21 times across all tranches, it stated.

It also recorded one of the highest levels of non-UAE investor participation among recent government-related listings on the DFM, signalling the continued diversification of Dubai’s investor base, it added.

To mark the listing, Barry Lewis, Chief Executive Officer of Alec Holdings, rang the market-opening bell at DFM in the presence of Helal Al Marri, Chairman of the DFM Board of Directors, and Hamed Ali, Chief Executive Officer of DFM and Nasdaq Dubai.

Speaking on the occasion, Lewis said: "Today marks a proud and defining milestone in Alec’s journey. Our listing on the Dubai Financial Market reflects over two decades of steady growth, operational excellence, and a steadfast commitment to delivering complex, high-quality projects that define skylines and advance transformational national ambitions across the UAE and Saudi Arabia."

"This achievement is the result of the collective dedication of our people and the trust of our clients and partners, who have been instrumental to our success. It also represents the beginning of a new chapter, one that will see Alec continue to grow, innovate, and create sustainable long-term value under the enhanced governance and transparency that come with being a listed company," stated Lewis.

"The DFM has played a vital role in enabling our successful IPO journey, offering a dynamic platform that attracts a broad mix of high-quality investors, including leading regional and international institutions. We are proud to join a market that is driving capital market development in the region and look forward to continuing our growth story as a listed company," he added.-TradeArabia News Service

.jpg)

.jpg)

.jpg)