The FM industry is rapidly evolving from routine upkeep to a strategic, essential role.

The FM industry is rapidly evolving from routine upkeep to a strategic, essential role.

The facilities management (FM) industry across the region is on the cusp of a major transformation, with market size forecast to nearly double by the end of the decade, driven by infrastructure expansion, regulatory shifts, digital integration, and growing demand for sustainable building operations.

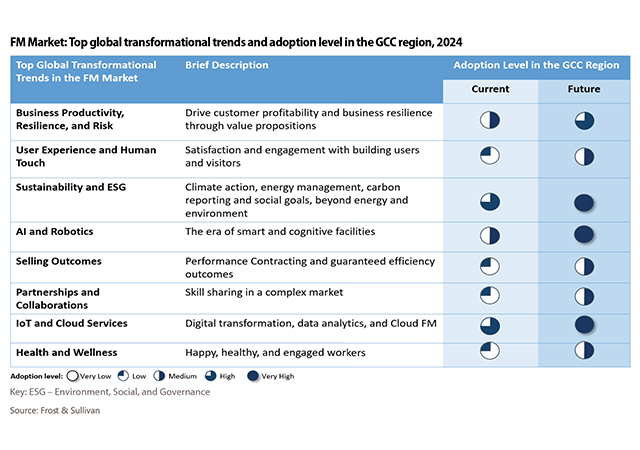

The FM industry is rapidly evolving from routine upkeep to a strategic, essential role, significantly impacting asset longevity, operational efficiency, and cost optimisation. This shift, highlighted in a MEFMA (Middle East Facility Management Association) published report done by Frost & Sullivan, means FM now drives core business objectives, aligning with sustainability, superior customer experience, and flexible work/living needs.

The industry is leveraging data-driven insights to deliver sustainable, user-centered solutions that cater to evolving demands for health, well-being, productivity, and environmental responsibility, according to the MEFMA report.

|

|

Hard services led the FM market last year. |

These trends will increasingly affect the GCC region, given the strong presence of global FM companies, though adoption rates will vary based on market maturity, infrastructure, and regulations.

According to Mordor Intelligence, the Middle East and Africa FM market is expected to grow from $170.77 billion in 2025 to $311.67 billion by 2030, representing a compound annual growth rate (CAGR) of 12.79 per cent. Much of this expansion is being led by countries in the GCC, where landmark projects and national development strategies are accelerating the adoption of integrated, outcome-based FM services.

The MEFMA report estimates that the total FM market across the GCC reached $54.6 billion in 2023 and is projected to grow to $72 billion by 2028 at a CAGR of 5.7 per cent.

The growth is largely driven by mega developments in Saudi Arabia and the UAE, a rising trend in outsourcing, and greater focus on digitalisation and environmental performance.

FM is shifting from traditional, cost-based services to playing a central role in delivering strategic value, especially in the realms of sustainability, digital transformation, and end-user experience, the MEFMA report noted.

|

|

|

Speaking to Gulf Construction, President of MEFMA Jamal Lootah states: “The facilities management sector in the GCC is undergoing a profound transformation. With mega projects in Saudi Arabia and the UAE, coupled with urban expansion and sustainability agendas, facilities management is now central to delivering efficiency and end-user satisfaction. At MEFMA, our role is to empower members with the knowledge, partnerships, and resources they need to compete effectively while aligning with national visions.”

UAE: Region’s most mature FM market

The UAE remains the fastest maturing FM market in the GCC, supported by ongoing real estate development, robust infrastructure investments, and aggressive smart city initiatives.

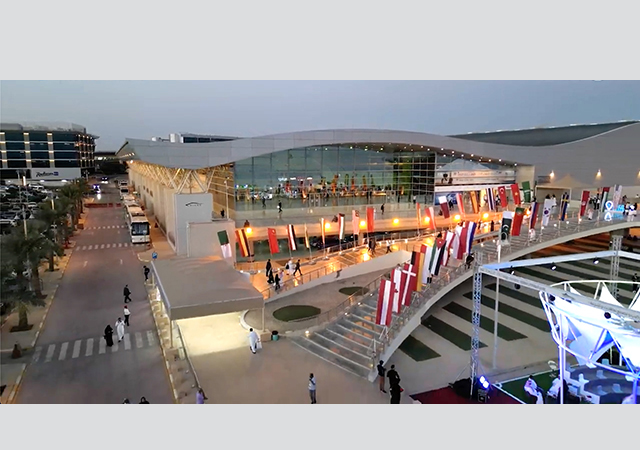

, UAE.jpg) |

|

|

The UAE’s total FM market stood at $12.9 billion in 2023, and is expected to reach $17.7 billion by 2028, with a CAGR of 6.5 per cent, according to the MEFMA report. Outsourcing accounted for 46 per cent of the total, or around $5.9 billion, with high potential for further growth driven by increasing property management sophistication and cost-efficiency imperatives.

Government policies such as the Dubai Clean Energy Strategy 2050, Estidama Pearl Rating System, and the Circular Economy Policy 2021–2031 are creating a strong foundation for green FM solutions. The market is witnessing growing uptake of energy-saving retrofits, smart building solutions, and predictive maintenance powered by data analytics and IoT.

Saudi Arabia: Strong growth potential amid transition

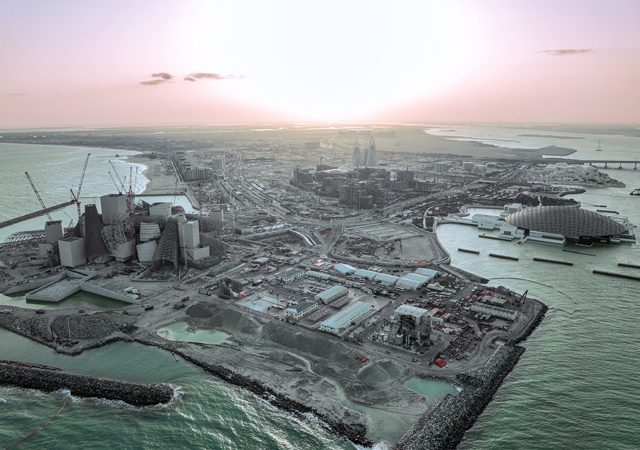

, KSA.jpg) |

|

|

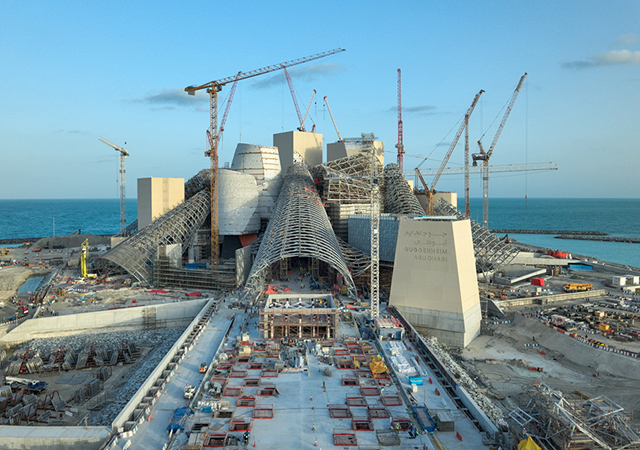

According to the MEFMA report, the FM market in Saudi Arabia was valued at $37.35 billion in 2023, and is projected to expand to $49.45 billion by 2028, with a CAGR of 5.8 per cent. While the market is currently dominated by in-house services and basic maintenance contracts, the rise of giga-projects under Vision 2030 is expected to drive large-scale outsourcing and integrated FM adoption.

According to Mordor Intelligence, Saudi Arabia represented 17.84 per cent of the total Middle East and Africa FM market in 2024, making it a regional leader in FM potential.

The MEFMA report pointed out that integrated FM contracts remain under-penetrated, making up only four to five per cent of the total market, compared with nine to 10 per cent in the UAE and 30 to 32 per cent in global markets.

Public-private partnerships in the education and airport sectors, and private investment in residential and hospitality projects like NEOM, Qiddiya, The Red Sea Project, and Amaala, are creating strong tailwinds for professional FM players.

|

|

Demand for FM in the industrial and process segment is expected to grow the fastest. |

Rest of the GCC: Mixed maturity, growing momentum

Other GCC markets, including Qatar, Oman, Kuwait, and Bahrain, represent a combined but more fragmented FM landscape. Adoption of outsourced and integrated services varies, although all markets are benefitting from infrastructure development and Vision-driven economic diversification.

• Qatar: Post-World Cup momentum is sustaining demand for FM, especially in industrial zones, healthcare, and hospitality. The market stood at $3.94 billion in 2023, projected to reach $5.26 billion by 2028 (CAGR: 5.9 per cent). Outsourcing accounted for 44 per cent in 2023, according to the MEFMA report.

• Oman: With 24 per cent outsourcing, Oman’s FM industry is being transformed under Vision 2040, with demand rising from new airports, schools, and tourism facilities. Public-private partnerships are reshaping service delivery models, the report added.

• Kuwait: Infrastructure expansion under Vision 2035 is driving some FM growth, but outsourcing remains underdeveloped, with less than 20 per cent of services outsourced. Integrated FM penetration is below six per cent, stated the MEFMA report

• Bahrain: Though a smaller market, Bahrain is the fastest-growing FM market in the region, expanding at a 13.18 per cent CAGR through 2030, per Mordor Intelligence.

According to the MEFMA report, integrated FM penetration is at 8.5 per cent, higher than most GCC peers.

Market Structure: Hard Services Dominate

Across the broader Middle East and Africa FM landscape, hard services – including mechanical, electrical and plumbing (MEP), heating, ventilation and air-conditioning (HVAC), security systems, and fire safety –led the market with a 56.8 per cent share in 2024, according to Mordor Intelligence. However, soft services like cleaning, catering, and janitorial operations are set to post a higher growth rate of 13.15 per cent CAGR through 2030.

In terms of delivery models, outsourced FM accounted for 63.9 per cent of the market in 2024, projected to rise further due to the shift to performance-based agreements that link fees to uptime, energy use, and occupant comfort metrics.

Integrated FM and outsourcing are becoming strategic imperatives, not just operational choices, according to the Mordor Intelligence report. The focus is now on full-service models that integrate facilities, people, and technology.

Commercial and industrial sectors drive growth

By sector, the commercial category accounted for 38.9 per cent of total FM revenue in 2024, but the industrial and process segment is expected to grow the fastest at a 15.01 per cent CAGR through 2030, the Mordor Intelligence report stated. This trend reflects the increasing complexity of manufacturing operations and growing demand for uptime and safety across oil, gas, and logistics facilities.

FM service providers are increasingly expected to deliver measurable business outcomes through remote asset management, digital twin platforms, and energy optimisation tools.

Outlook: Digitalisation, ESG, and Consolidation

Both reports underscore five key trends shaping the future of FM in the Middle East:

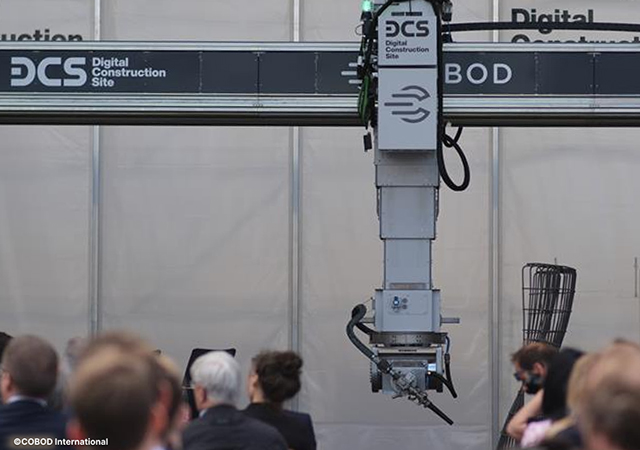

• Digital transformation: Technologies like IoT, AI, digital twins, and predictive analytics are central to driving efficiency and reducing costs. Performance contracts are shifting capital expenses into operational expenditures.

• Sustainability and ESG: FM providers are expected to support clients’ Net Zero targets, ESG reporting, and healthy building certifications.

• Customer-centric delivery: A transition from manpower-based, cost-focused models to outcomes-based, value-added solutions is under way.

• Market consolidation: The growing complexity of FM contracts and technology integration is favouring large providers, with smaller players likely to be acquired or outcompeted.

• New business models: The rise of “anything-as-a-service” (XaaS) platforms is altering how FM services are bought and delivered, opening new revenue opportunities.

As FM transitions from a support service to a strategic enabler of operational and environmental performance, the Middle East and GCC markets are poised to lead global trends – setting new standards in technology integration, customer value, and sustainability.

.jpg)

.jpg)

Doka (2).jpg)

.jpg)

.jpg)

.jpg)