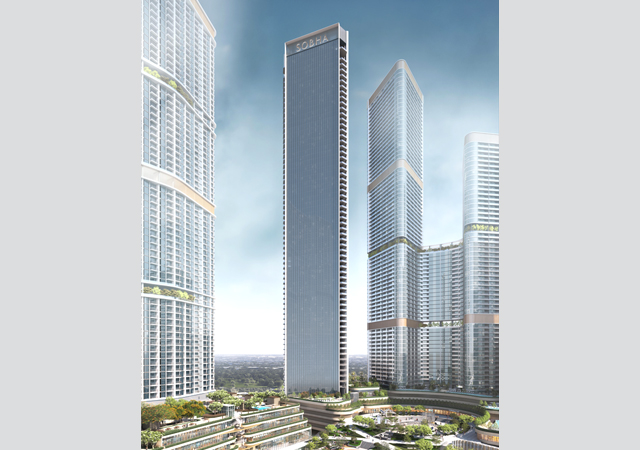

Four Seasons will operate a hotel at the kilometre-high Kingdom Tower in Jeddah, which is currently under construction and will be the world’s tallest building on completion in 2018.

Four Seasons will operate a hotel at the kilometre-high Kingdom Tower in Jeddah, which is currently under construction and will be the world’s tallest building on completion in 2018.

More than 100,00 hotel rooms are planned for the GCC by 2019, with as many as 44 chains now entering the market, to cater to the surge in visitors anticipated over the next 15 years.

The hospitality industry in the GCC is riding high on the back of the growing leisure and business visitor numbers to the region, attracting new hotel chains as well as driving existing chains to add more rooms to their count to meet demand.

And although a majority of the upcoming hotels are five star, there are some big names in the industry that are also investing significantly in budget hotels.

According to a recent survey by Viability Management Consultants (VMC), more than 390 hotels and hotel apartment buildings with 101,123 keys will be developed until 2019 across the GCC – the first time that the hotel pipeline has broken the 100,000-unit mark. The study canvassed 134 chains of which 72 confirmed a future pipeline of projects.

“Almost 80,000 rooms or 80 per cent of the pipeline is expected to materialise between 2014 and 2016, with the remainder opening by 2019. Major deadlines like those of Expo 2020 in Dubai and the 2022 Fifa World Cup in Qatar should help ensure that construction programmes stay as per schedule,” says Guy Wilkinson, managing partner of VMC.

With 28,419 keys, the UAE emirate of Dubai has more than twice the pipeline of its nearest rival, Makkah in Saudi Arabia (13,724), which was followed in the top 10 by Doha in Qatar (10,777); Abu Dhabi in the UAE (9,058); Riyadh (8,954) and Jeddah (7,969), both in Saudi Arabia; Muscat, Oman (4,587); Manama, Bahrain (3,078); Al Khobar/Dhahran/Dammam (1,729) in Saudi Arabia; and impressively, Ras Al Khaimah, UAE (1,698).

|

|

Opening in 2017 ... Katara Towers in Lusail, Qatar, will include a five-star hotel, a six-star hotel and branded apartments together offering a total of 614 rooms. |

This is confirmed by a recent report by Deloitte and STR Global, which has positioned Dubai as a leading global hospitality destination citing significant increase in the demand for hotel accommodation in emirate in the last seven years.

The report, entitled ‘Middle East Hotel Market Insight’, finds that the demand measured in rooms sold across the upmarket sectors has risen by almost 79 per cent between 2006 and 2013. Saudi Arabia drove the largest number of visits to Dubai in 2013 (1.4 million visits), followed by India (0.9 million visits) and the UK (0.75 million visits). Looking to the future, key growth markets for Dubai are likely to comprise Saudi Arabia, the Russian Federation, India and Iran.

In 2006, Dubai had a total of 233 hotels providing almost 39,000 rooms across all sectors of the market, including 152 unaffiliated or independent hotels. By Q1 2014, this total stock of hotels had grown by almost 48 per cent with the addition of 111 new hotels. If the unaffiliated hotels are excluded, Dubai’s branded hotel market grew by over 105 per cent from 81 hotels in 2006 to 167 in Q1 of 2014, the report said.

“Despite the large supply growth in Dubai over the past few years, the market has been able to absorb the supply, and performance continues to tick upward,” says Phillip Wooller, area director, STR Global.

Dubai is expected to add a whopping 160,000 hotel rooms by 2020, when it will host the World Expo.

An interesting development highlighted by the Viability Management Consultants study is that a number of hotel chains are now opening in many provincial towns across the Gulf region including Ajman and Khor Fakkan in the UAE; Al Ahsa, Baha, Hail, Jizan, Jubail, Tabouk, Unaiza, Yanbu and Qurayyat in Saudi Arabia; and Duqm, Jebel Akhdar and Sohar in Oman.

“This reflects not only the rapid economic or tourism development of such locations, but also the maturing of the large chains to the extent that they have established their key brands in primary locations and are now seeking to develop their networks into secondary and tertiary communities,” says Wilkinson.

|

|

Stunning architecture ... the 100-room ME by Meliá at the Opus. |

Viability’s research showed that there were 140 different brands (as distinct from the 72 chains) in this year’s pipeline, of which 44 were completely new to the region. The research highlights that hotel investors want new names that help differentiate their properties, while operators need to add brands so that they can offer fresh options to compete in increasingly saturated — and product-differentiated — destinations.

Some 61 per cent of the pipeline keys will be rated five star, 30 per cent four star, nine per cent three star (mainly comprising the 10 Premier Inns in the pipeline), and just one two-star property, the Swiss-Belinn Ghubrah Muscat, the VMC study indicated.

This year, 22 chains each declared more than 1,000 rooms under development bringing the average number of keys per property under development by each of the 71 chains that declared pipeline activity at 259.

Hilton Worldwide tops the list with 9,593 keys (30 hotels), followed by Starwood with 7,912 keys. The other management companies in the top 10 comprise Marriott, Accor (31 properties), Rotana, InterContinental Hotels Group, Millennium and Copthorne, Wyndham, Hyatt and Golden Tulip.

In the top 20, local company Anjum has one single upcoming hotel in Makkah boasting 1,743 keys, while Time Hotels from Dubai is now expanding beyond the UAE into Doha and Riyadh, and Bin Majid from Ras Al Khaimah is spreading from its provincial base into Abu Dhabi and Dubai.

Another local name that is expanding is the Gulf Hotel, which in addition to a five-star hotel in Bahrain, also manages the K Hotel in the kingdom and the Ocean Paradise Resort in Zanzibar. By 2017, it will be running two further ‘Gulf Hotel’-branded hotels, one in Bahrain’s Amwaj Islands and the other in Dubai’s Business Bay.

In Qatar, the Souq Waqif Boutique Hotels will open its seventh property, Soy, shortly with just 19 rooms.

In Dubai, Teal Hospitality will open a second hotel under its Cosmopolitan brand – the Grand Cosmopolitan – in 2016. And Warwick International Hotels recently opened on Dubai’s Sheikh Zayed Road, while a hotel in Doha is due to open in phases over the next few years.

|

|

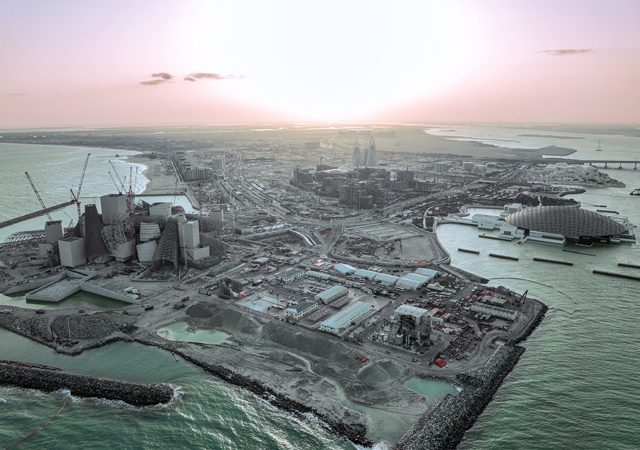

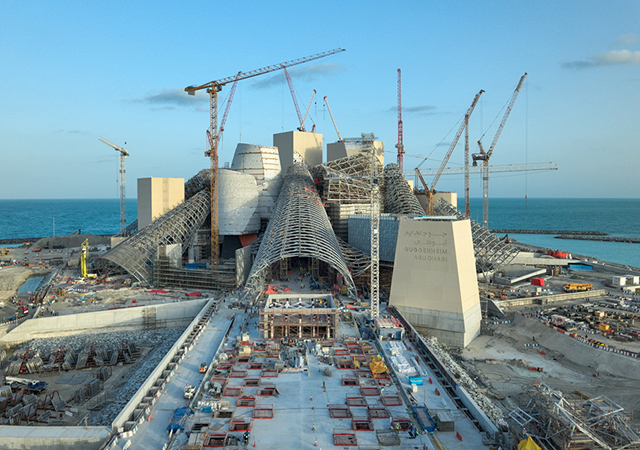

The 354-room Saadiyat Rotana in Abu Dhabi is on track to open in 2015. |

A number of new names also made into the VMC survey list this year. Spanish resort operator Blue Bay, for example, will be opening two properties in Dubai, with further expansion expected soon in other emirates. Thai hotel company Centara Hotels and Resorts will make its Gulf debut with two hotels in Doha. The Emirates Grand Hotel in Dubai has now become a brand that will operate a hotel apartments property in Dubai and a hotel in Sharjah.

Meanwhile, hotel or serviced apartments are also an increasingly attractive option for many operators. Specialist apartment-only operators Frasers and The Ascott, both from Singapore, are introducing more of their brands, including Fraser Place, Fraser Residence and Ascott’s mid-scale Citadines, a popular European aparthotel concept. In Dubai, there is a trend to offer ‘condo apartments’ or hotel apartments that are sold individually as freehold. Following the lead of The Address and other early pioneers, Dubai developer Damac has embraced the concept wholeheartedly, having established its own Damac Maison management company/brand for the purpose of offering serviced apartments to its buyers. According to a Damac official, the company has some 9,000 condo apartments under development, with a major concentration in Dubai’s Downtown and Business Bay districts.

Among global chains, Accor will introduce its first Ibis Styles-branded hotel at Dragonmart next year. It has also recently opened its first Grand Mercure Majlis hotel, with an Arabian concept, in Madinah, Saudi Arabia. Mid-scale operator Best Western will soon open two hotels in Saudi Arabia under its upscale Best Western Premier brand. Fellow US lodging giant Wyndham is introducing two new mid-scale brands, Tryp and Wyndham Garden, at properties in Dubai and Doha respectively. Meanwhile, Dusit and Steigenburger are debuting two mid-scale brands, D2 and Intercity in the region.

Boutique and lifestyle hotels are definitely popular in the GCC pipeline this year. Two operators are promising to open contemporary grand hotels: the Oetker Collection, with its Hotel Le Bristol, and Millennium, with its Biltmore Hotel, planned to come up in Abu Dhabi in 2015 and 2017 respectively. In Dubai, a new joint venture company established by MGM and Abu Dhabi-based Hakkasan, called MGM Hakkasan Hospitality, is planning three lifestyle hotels – MGM Grand, Skylofts and Bellagio – to be opened by 2018 at the Dubai Pearl project facing The Palm Jumeirah. Next door will be a lifestyle hotel under the Baccarat brand of Starwood Capital.

|

|

Under construction in Oman ... Jumeirah at Saraya Bandar Jissah is expected to open in 2017. The resort will consist of two hotels, one with 206 rooms and the other with 106. |

The big chains are also entering the Gulf’s lifestyle sector. Marriott has confirmed it will debut both its Autograph and Bulgari brands in Dubai, which will also be the venue for Wyndham’s first Dream hotel in the region, with 720 keys within the 101-storey Marina 101 tower, which is claimed to be the tallest luxury hotel and serviced apartments building in the world. Another first in the region will be IHG’s upcoming Hotel Indigo in Riyadh, while a Hyatt Andaz hotel is rumoured for Dubai.

Spanish operator Meliá has been appointed to manage a 100-room ME by Meliá designer hotel in Omniyat’s iconic 95-m-high Opus building in Dubai, which is designed by leading architect Zaha Hadid. Millennium has plans for local launches of its trendy Studio M and M Hotel concepts, and Accor for its lifestyle M Gallery concept in Doha. These are in addition to new lifestyle hotels to be opened soon by Morgans of New York, Nobu (in joint venture with Saudi Arabia’s Dhaliliyah Establishment) and Paramount, a new Dubai-based chain working with the prestigious Hollywood studio brand.

However, groups like Wyndham Hotel Group and Emaar Hospitality Group also have significant budget hotel pipelines. Wyndham is opening nine Days Inn hotels with a total of 800 keys, as well as 19 Super 8 hotels totalling 900 rooms, all in Saudi Arabia with investment partners there. Both brands are new to this region. And Emaar is partnering with Meraas, a Dubai government development company, to open a reported five budget hotels in the city under a new brand called Dubai Inn. Union Properties, another leading Dubai developer, has also promised to build 1,000 ‘affordable’ hotel rooms in the next five years. It is worth noting that there continues to be major investment in budget hotels across the GCC, but mostly by owner-operators with no chain affiliation.

.jpg)

.jpg)

Doka (2).jpg)

.jpg)

.jpg)

.jpg)