Work was launched last year on the expansion of Dubai’s $35-billion Maktoum International Airport.

Work was launched last year on the expansion of Dubai’s $35-billion Maktoum International Airport.

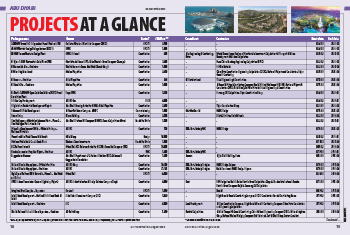

The Gulf Cooperation Council (GCC) is investing heavily in airport infrastructure, with $182.6 billion worth of projects under way and a strong focus on mega-hubs in Dubai and Saudi Arabia. These projects are set to dramatically increase passenger capacity, enhance connectivity, and support the region's ambitions as a global aviation and tourism powerhouse.

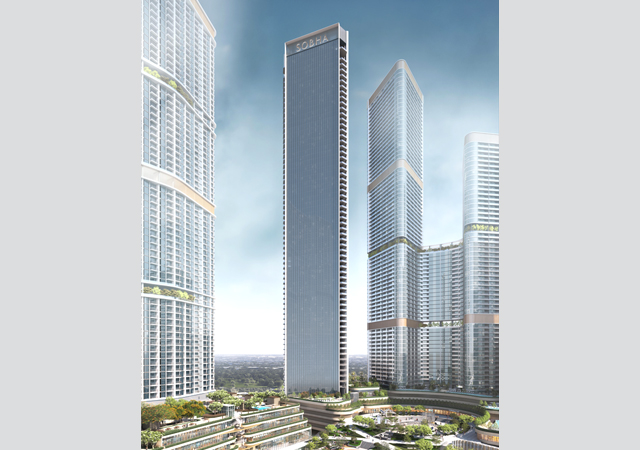

Two monumental developments, each aiming to be the largest of its kind in the world, are under way – Riyadh’s King Salman International Airport (KSIA), which in May made key appointments that will help spearhead the project, and Dubai’s Al Maktoum International Airport expansion. These projects aim to handle 185 million and 260 million passengers annually, respectively.

These two mega-projects alone reportedly account for nearly 80 per cent of the total spending on airport development across the Middle East and North Africa (Mena) region.

The air passenger traffic in the Middle East is projected to increase by 300 per cent to 1.1 billion by 2040, highlighting the urgent need for expanded infrastructure.

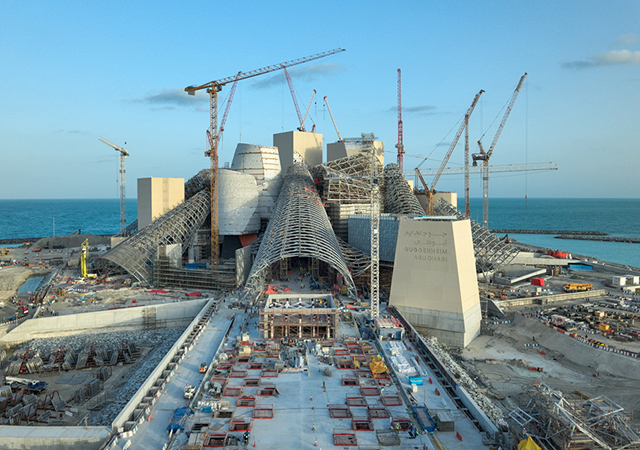

Saudi Arabia intends to invest $50 billion in the King Salman International Airport, which aims to become the world's largest airport upon its completion in 2030.

Dubai has commenced construction on what is set to be the world's largest airport terminal, a $35-billion endeavour featuring 400 gates and five parallel runways.

According to London-based analytics firm Global Data, GCC airports are undertaking 48 renovation, expansion, and new construction projects valued at an estimated $182.6 billion, as the region anticipates a significant surge in air passenger numbers.

Mordor Intelligence’s GCC Aviation Infrastructure Market Report estimates the market size as $135.05 billion in 2025, and expects it to reach $163.83 billion by 2030, at a CAGR of 3.94 per cent during the forecast period (2025-2030). Significant growth in terms of commercial aircraft operations, the number of passengers, and infrastructure projects to meet future aviation requirements in the GCC region is expected to lead the market to grow considerably in the coming years, says the report.

The growing number of commercial aircraft operations and commercial aircraft acquisitions by major air carrier companies will lead aviation authorities in the GCC region to enter partnerships with established infrastructure companies to ensure the development of sustainable airport infrastructure projects that are capable of handling future aviation requirements, thereby driving the market in the long run, it states.

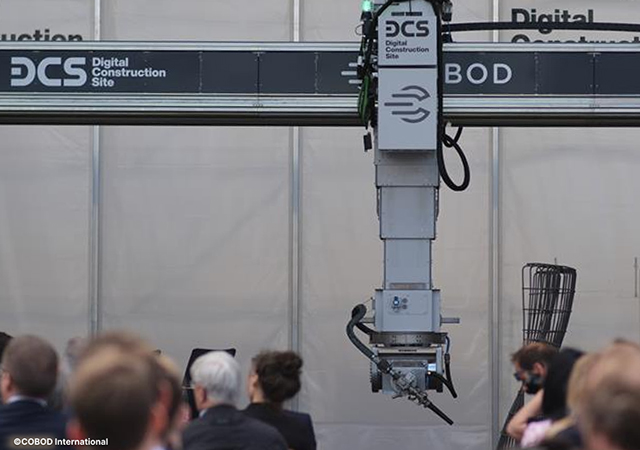

New projects are integrating advanced technologies, automation, and sustainability features to enhance passenger experience and operational efficiency.

Bahrain

Bahrain has plans on the drawing board for a new 40-million-passenger capacity international airport to replace its existing hub. The estimated $10-billion greenfield project is expected to be built on reclaimed land off Muharraq island.

Kuwait

A new triangular terminal – T2 terminal – with 28 gates at Kuwait International Airport is slated to become operational by 2026, increasing the airport’s capacity to up to 50 million passengers per year.

The $4.34-billion airport expansion project is divided into three phases: the first includes the passenger terminal, central station and service tunnel connections; the second phase comprises car parks, service buildings and access roads; and the third involves aircraft parking and taxiways.

The passenger terminal is designed to achieve LEED Gold certification. It is being built by Turkish company Limak Insaat, and will triple the airport’s capacity to 25 million passengers annually.

Earthworks are under way for Phase Three of the project. This phase involves several critical tasks, including the construction of the catering building, technical support centre, security checkpoints, employee and cargo inspection areas, waste disposal zones, service tunnels, and aircraft taxiways and parking areas.

Reports suggest that the project is targeted for completion next year.

Oman

Muscat International Airport, which has seen its capacity increase to handle 20 million passengers annually, aims to further increase this capacity to 24 and ultimately 48 million passengers per year in further expansion phases. Efforts to develop the airport complex are now focused on diversifying its revenue sources. For instance, an agreement has been signed to set up a world-class gold refinery facility in Phase Two of the Logistics Gate with foreign direct investment. Furthermore, a partnership was established this year to create an academy and research and development centre for drones at the Business Gate. Plans are also under way to construct a bonded warehouse on a 40,000-sq-m plot at the airport, and a concession agreement has been granted for the management and operation of the landside airport hotel.

In addition, the sultanate has plans to construct six new regional airports by 2029, which will bring the total number of such facilities in the country to 13.

Late last year, Oman’s Civil Aviation Authority (CAA) launched a tender for the masterplanning and design of three new domestic airports at Al Jabal Al Akhdar, Masirah Island, and Suhar. Design work has also been completed for Musandam airport, which is anticipated to be operational by 2028.

|

|

Hamad International Airport’s Concourse E was opened earlier this year. |

Qatar

Early this year, Hamad International Airport announced the opening of Concourses D and E, marking a major milestone in its expansion and increasing its capacity to over 65 million passengers annually.

The new concourses integrate seamlessly into the existing terminal, introducing cutting-edge technology and enhanced facilities to meet growing passenger demand. The terminal now spans 845,000 sq m – a 14 per cent increase – while the addition of 17 new aircraft contact gates increases the total to 62, nearly 40 per cent more than before, ensuring greater connectivity, streamlined operations, and significantly reducing bus transfers.

Saudi Arabia

Saudi Arabia’s aviation strategy aspires to establish the kingdom as a global aviation hub. It also aims to enhance air safety, improve the traveller experience, and achieve long-term environmental sustainability.

According to the Saudi General Authority for Civil Aviation, key goals of the strategy including doubling passenger handling capacity to reach 330 million passengers annually from over 250 destinations worldwide and increasing cargo capacity to 4.5 million tonnes of goods by 2030.

|

|

King Salman International Airport ... expected to be a $50-billion investment. |

The kingdom’s efforts at boosting its tourism potential have already begun to bear fruit with the air transport sector having achieved unprecedented records in passenger numbers in 2024.

Over 128 million travellers passed through various airports across the kingdom, with 59 million on domestic flights and 69 million on international routes, This marks a 15 per cent increase compared to 2023 and a 25 per cent rise from pre-pandemic levels, confirming the recovery of the aviation sector from the impacts of Covid-19.

To achieve the target of 330 million passengers annually, Saudi Arabia’s ambitious Aviation Strategy envisages a massive expansion, fuelled by public and private sector investment of $100 billion, all by 2030. In fact, the kingdom’s aviation sector is currently witnessing significant development and investment, with global players showing strong interest in new projects and its existing infrastructure undergoing major upgrades.

The Saudi Civil Aviation Holding Company (Matarat), in collaboration with the National Center for Privatization & PPP, has announced that several leading international airport developers are competing for the development of Taif International Airport. A total of 90 companies, including 46 local firms, have expressed interest in the project. The new Taif International Airport project aims to achieve a capacity of 2.5 million passengers per year by 2030 and will involve the construction of a new runway, taxiways, apron, a passenger terminal, buildings, and support facilities.

In December last year, Matarat invited Requests for Proposal for the Privatisation of the New Abha International Airport Project. The airport, which has been designed to reflect the architectural identity and heritage of the Aseer region, is expected to accommodate up to 10 million passengers per year on completion in 2028.

However, all eyes are on the development of King Salman International Airport in Riyadh which is designed to become the world’s largest airport. Being built around the current King Khalid International Airport, the airport is being designed by British architectural firm Foster + Partners (see Page 28).

Meanwhile, work is nearing completion on the Red Sea International Airport on Saudi Arabia’s west coast, which is projected to accommodate one million passengers annually by 2030, with a peak capacity of 900 passengers per hour.

In the Eastern Province, Hill International has secured a project management consultancy contract with Dammam Airports Company (DACO) for multiple improvement projects at King Fahd International Airport in Dammam, as well as Al Ahsa International and Al Qaisumah International airports. King Fahd International Airport is one of the kingdom’s four primary international airports, handling more than 10 million passengers annually and hosting 37 airlines. Hill will oversee 105 ongoing and upcoming projects for DACO over the three-year contract, including asset replacements and upgrades, IT enhancements and other landside and airside assignments.

UAE

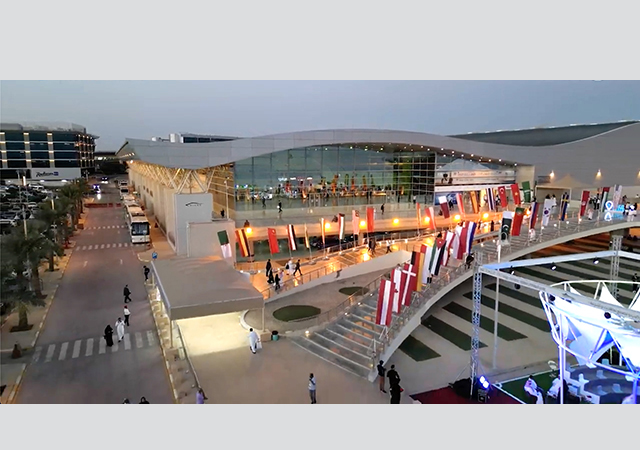

The development of the Al Maktoum International Airport in Dubai is progressing well and major contracts are likely to be awarded this year, according to Eng Khalifa Al Zaffin, Executive Chairman, Dubai Aviation City Corporation.

Contracts have already been awarded for the site enabling works and the construction of the second runway, he said at a press conference at the recent Airport Show in Dubai.

Several major packages required for the first phase of the project – including the automated people mover (APM) and the baggage handling system (BHS) – are currently in the tendering stage, with contracts expected to be awarded later this year.

Additionally, the terminal substructure, early 132 kV substations, and district cooling plants are the next packages to be tendered this year, laying the foundation for the subsequent phases of delivery.

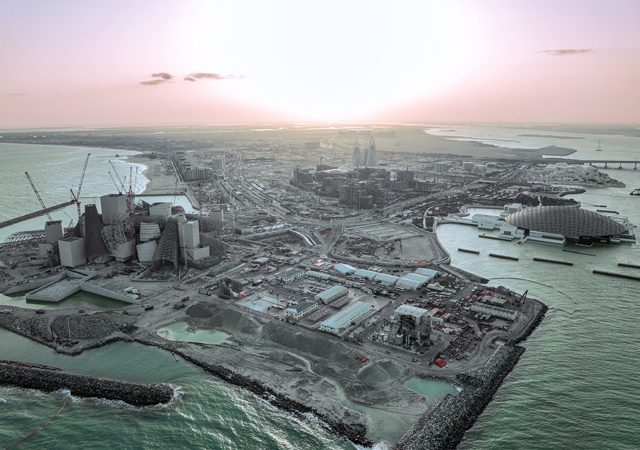

Dubai last year launched the $34.8-billion expansion of Al Maktoum International Airport, set to replace Dubai International Airport as the emirate’s primary aviation hub. Almost five times the size of Dubai International Airport, Al Maktoum International will comprise five parallel runways, west and east processing terminals, four satellite concourses with 400 aircraft stands, a high-speed automated passenger transport system, and an integrated landside transport hub for roads, metro, and city air transport.

Work is also in progress on the expansion of Sharjah International Airport, which is designed to enhance capacity to accommodate 20 million passengers annually. Some of the projects completed include the public services building, new aircraft parking stands, the design of a road network to link the new terminal with existing facilities, and the vehicle parking areas.

The expansion work will include building an additional runway, designing a new passenger terminal.

Completion of the entire expansion is anticipated by the close of 2027.

.jpg)

.jpg)

Doka (2).jpg)

.jpg)

.jpg)

.jpg)