Oman’s construction industry is in the midst of an upsurge, driven by ambitious government initiatives aimed at diversifying the national economy and enhancing infrastructure under the framework of the sultanate’s Vision 2040. In line with this drive, the sultanate is witnessing expansion and growth in various sectors ranging from real estate and industry to oil and gas and renewables, which in turn is providing impetus to the construction sector.

The construction sector is projected to grow by 3.6 per cent in 2025, reaching a market value of RO3.81 billion ($9.9 billion), and is expected to maintain a positive trajectory with a compound annual growth rate (CAGR) of 2.8 per cent between 2025 and 2029, according to Research and Markets, a leading source for market data and statistics. This growth is underpinned by significant investments across various infrastructure segments, including airports and ports, roads and railways, power and water infrastructure, oil and gas projects, industrial developments, and the real estate sector.

Real estate development is a major area of focus and the level of interest was apparent at the Oman Real Estate Conference and Exhibition last month, where major regional players such as Egypt’s Talaat Moustafa Group (TMG) confirmed interest in developing ambitious developments in the sultanate. TMG will develop two projects – one in the country’s ambitious Sultan Haitham City and the other along on Shakhakhit coast – under an investment worth over RO1.7 billion ($4.4 billion).

The event also witnessed the launch of A’ Thuraya City in the Wilayat of Baushar – the first phase which includes more than 2,600 housing units – and the Al Jabal Al Aali Project, a unique global mountain destination.

|

|

A’ Thuraya City ... set on the mountains near Muscat. |

Oman’s Ministry of Housing and Urban Planning (MoHUP) is spearheading development of many of the attractive mixed-use projects such as Sultan Haitham City, a flagship sustainable urban development, Al Khuwair Muscat Downtown and Waterfront Development and New City Salalah, A’ Thuraya City, which will include thousands of homes alongside hotels, commercial and retail facilities.

According to a report by leading real estate and advisory consultant, Cavendish Maxwell, Oman is poised to deliver 62,800 new residential real estate units by 2030, with 5,500 coming to market this year in line with the country’s strategic vision. In addition, the sultanate is set to add 5,800 hotel rooms to its current inventory over the next five years, with 35 new hotels and resorts scheduled to open by 2030. The new rooms will boost current inventory by around 25 per cent, the report adds.

|

|

The Marina plaza at New City Salalah. |

Oman’s tourism sector is undergoing a period of rapid expansion and transformation, driven by a national strategy to diversify the economy beyond hydrocarbons and capitalize on the country’s unique natural and cultural assets. State-owned tourism development company Omran has announced plans to invest $3 billion over the next five years in strategic tourism projects and is reported to have succeeded in attracting almost $2 billion in foreign investments for various projects. These funds will support the construction of luxury resorts, eco-friendly developments and infrastructure improvements, which will further position Oman as a premier tourism destination. Some 40 new hotels are expected to be added to the country’s hospitality portfolio by the end of next year.

The industrial sector also continues to be a vital contributor to the Omani economy, accounting for 19.5 per cent of the GDP by June 2024, demonstrating the success of diversification policies. A notable increase in foreign direct investment (FDI), particularly within the manufacturing sector, and the development of key industrial and business zones, such as the Special Economic Zone at Duqm, further contributes to the vibrant construction landscape.

|

|

Oman Botanic Garden ... expected to be completed by the year-end. |

The Public Authority for Special Economic Zones and Free Zones (OPAZ) reported a total investment of RO21 billion in its supervised zones by the end of 2024, marking a 10 per cent increase compared to the previous year. which indicates the favourable investment climate fostered by the Omani government.

Furthermore, Oman is making significant strides in its renewable energy sector, aiming for a 30 per cent share in the electricity mix by 2030. The inauguration of the 1 GW Manah 1 and 2 Independent Power Project (IPP), the sultanate’s largest solar plant, in early 2025 represents a major milestone in this endeavour.

The sultanate is completing a number of ongoing tourism and infrastructure projects later this year such as Oman Cultural Complex, Oman Botanic Garden and waterfront in the Wilayat of Al Ashkharah, along with major road projects like Khasab-Daba-Lima Road, Al Sharqiyah Expressway, Adam-Thumrait Road, and Ansab-Jafnain dualisation project.

Continued government commitment to infrastructure development, coupled with increasing foreign direct investment, is expected to sustain the sector’s growth momentum.

While challenges such as sensitivity to oil price fluctuations and the need to address skilled labour shortages remain, Oman’s strategic geographic location, stable political environment, and investor-friendly policies position it as an attractive destination for construction and related investments.

Real Estate

The Omani government has implemented policies allowing 100 per cent foreign ownership in certain real estate projects, enhancing investor confidence and attracting international capital.

_MoHUP Pocket Park sml.jpg) |

|

Sultan Haitham City... designed as a sustainable urban development. |

Oman’s real estate market experienced a significant upswing in 2024, with the total value of transactions rising by 29.6 per cent to reach RO3.38 billion. Foreign investment played a pivotal role in this growth, contributing 70 per cent of the total investments in the sector up to September 2024.

According to the report by Cavendish Maxwell Oman’s residential real estate inventory grew by 3.6 per cent in 2024, with 38,400 new homes delivered, taking the current supply to around 1.1 million units. Most of the residential supply is in Muscat, followed by Al Batinah North and South, and Dhofar.

More than 80,000 new homes are projected to be delivered between now and 2040. However, despite tens of thousands of new properties in the pipeline, Oman’s rapid population growth could mean a shortfall in residential property supply in the future, says Cavendish Maxwell, which predicts that another 340,000 new homes would be needed to support a sustainable, 90 per cent occupancy rate.

To meet the anticipated demand, several major real estate projects are currently under way, poised to reshape Oman’s urban landscape. Among the landmark developments, Sultan Haitham City in Muscat is witnessing rapid construction progress, particularly in its Al Wafa and Al Sarooj Oasis neighbourhoods (see Page 5).

Another transformative project is the New City Salalah, a waterfront development masterplanned by Sasaki. The project will feature over 12,000 residential units and a 6 km public beach (see Page 14).

Construction is expected to begin by the end of this year Al Khuwair Downtown, envisioned as a vibrant urban hub in Muscat, integrating commercial, cultural, and entertainment spaces. This follows the completion of the detailed design phase on this $1.3-billion project. Tenders have now been announced for the design and build of the marina infrastructure works , including the breakwater (see Tenders)

Also under development is AIDA. Spanning 3.5 million sq m, this luxurious clifftop community will feature premium residences, hospitality, and leisure amenities, including the $500-million Trump International Oman and the $100-million Marriott Residences (see Page 17).

Meanwhile, infrastructure work is nearing completion on The Sustainable City (TSC) – Yiti, a large eco-friendly development near Muscat. Developed by Diamond Developers, a subsidiary of SEE Holding, in collaboration with Oman Tourism Development Company (Omran), TSC-Yiti aims to be the region’s largest operational sustainable community and Oman’s first net-zero emission community by 2040. Covering almost one million sq m, it will integrate smart technologies for low-carbon living and is expected to house around 10,000 people when fully operational in 2026. Work is well under way on the central plaza and the villas within the Sustainable District.

Airports & Ports

Muscat International Airport has undergone significant expansion in recent years taking its capacity to handle 20 million passengers annually in its first phase. Future expansion phases are planned to further increase this capacity to 24 and ultimately 48 million passengers per year. Efforts to develop the airport complex are focused on diversifying its revenue sources. For instance, an agreement has been signed to set up a world-class gold refinery facility in Phase Two of the Logistics Gate with foreign direct investment. Furthermore, a partnership has been established this year to create an innovative academy and research and development centre for drones at the Business Gate. Plans are also underway to construct a bonded warehouse on a 40,000 sq m plot at the airport, and a concession agreement has been granted for the management and operation of the landside airport hotel.

This apart, the sultanate has ambitious plans to construct six new regional airports by 2029, which will bring the total number of such facilities in the country to 13. Late last year, Oman’s Civil Aviation Authority (CAA) launched a major tender for the masterplanning and design of three new domestic airports at Al Jabal Al Akhdar, Masirah Island, and Suhar.

Design work has been completed for Musandam and tendering activity expected to commence shortly. The airport is anticipated to be operational by 2028.

In the ports sector, the Port of Salalah has recently completed a $300 million expansion project, increasing its container handling capacity from 4.5 million to 6.5 million TEUs.

Meanwhile Sohar Port is set to witness further industrial development with a $300-million polymer project which scheduled to commence production in the first quarter of 2026. Work on the facility, which will have a capacity of 350,000 tonnes per annum, was launched in December last year.

A liquefied natural gas (LNG) jetty, comprehensive shore protection, and an advanced drainage network are being built at the port, and Besix, a specialist in the design and construction of marine infrastructures, has just won the contract to implement this work (see Regional News).

Among other developments, the operator of Shinas Port, QS Maritime, has announced plans to invest RO77 million in the port’s expansion and modernisation. This project is expected to span between five and seven years, with work slated to begin before the end of 2025.

Roads

The Ministry of Transport, Communications and Information Technology has plans to implement a number of dual carriageway road projects across Oman, following the completion of major national and primary dual carriageways connecting the governorates, according to a Times of Oman report.

|

|

The Ministry of Transport, Communications and Information Technology is implementing a number of road projects across Oman. |

Last year, the Ministry of Transport, Communications and Information Technology for Transport awarded a number of road projects with a total value exceeding RO450 million, while a further projects worth more than RO600 million are expected to be awarded this year, it stated.

The sultanate has recently marked the completion of the dualisation of Sultan Said bin Taimur Road, spanning 400 km, making it the longest dual carriageway in the country, Another key road project being implemented at a cost of RO68 million is the Al Sharqiyah Expressway Phase Two, which is expected to be completed by mid-2026.

Work s now expected to be launched on the Muscat Expressway Widening Project, which will further enhance connectivity in the capital region. Consultants have been invited to provide supervisory services for the construction of the project. Tenders have also been announced for Phase Three and Phase Four of the Sinaw–Mahout–Duqm Road Upgrade Project, located in the Governorates of North Al Sharqiyah and Al Wusta, which will enhance connectivity to the Duqm Special Economic Zone.

Railways

Significant progress has been made on the Oman-UAE Hafeet Rail Project, a joint venture between Oman Rail, Etihad Rail and Mubadala, which is a significant step towards regional connectivity. The railway network will extend for 238 km from Sohar Port in Oman to the emirate of Abu Dhabi in the UAE. It will be connected to the UAE National Rail Network, and its terminals across the country. The network, which will feature 60 bridges, will link five major ports and various industrial and free zones across the two nations.

Hafeet Rail has awarded the construction contracts for state-of-the-art railway logistics facilities in Al Buraimi and Sohar to Larson & Toubro (L&T) and Power China, while the China Railway Rolling Stock Corporation (CRRC) has been contracted to supply a next-generation of high-performance freight wagons (See Page 28).

Power & Water

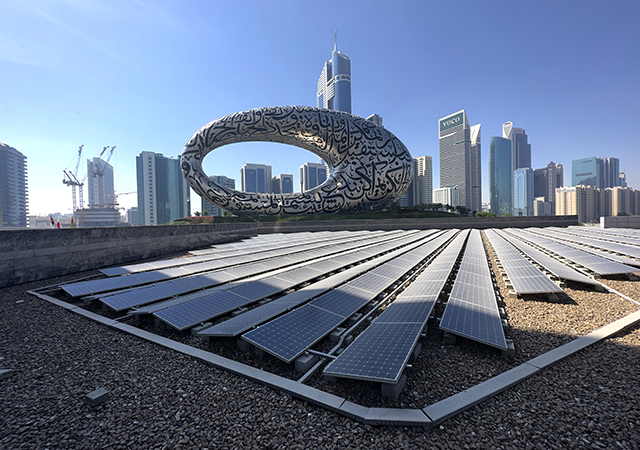

Oman has set ambitious targets for the integration of renewable energy into its electricity mix, aiming to achieve a 30 per cent share by 2030 and 70 per cent by 2040, with a long-term goal of net-zero emissions by 2050.

The sultanate is making significant strides in solar energy development. The Manah 1 and Manah 2 solar power projects, with a combined capacity of 1 GW, were inaugurated in January this year.

|

|

The 1 GW Manah 1 and 2 solar plant was inaugurated early this year. |

A number of other solar plants are on the anvil including the 500 MW Ibri III solar project. Four contenders are vying for the estimated RO155 million contract, according to Nama Power and Water Procurement (Nama PWP), the national agency overseeing the procurement of new capacity. The plant is slated to commence commercial operations in the first quarter of 2027.

Nama has also invited developers to qualify for the Al Kamil Wal Wafi Solar Independent Power Project, which is planned to have an initial capacity of around 500 MW, with potential expansion up to 1 GW.

Furthermore, TotalEnergies and OQ Alternative Energy (OQAE) have signed agreements to develop the 100 MW North Solar project, expected to be operational by late 2026, as well as two 100 MW wind projects with a similar completion timeline.

The two wind projects – Riyah-1 and Riyah-2 in southern Oman, are among a number of initiatives that the sultanate is taking to harness its wind energy potential. The Dhofar 1 Wind Energy Project, with a capacity of 50 MW, is already operational. The Authority for Public Services Regulation (APSR) has announced ambitious plans for additional wind energy projects in Duqm (250 MW), Jaalan Bani Bu Ali (100 MW), Dhofar 2 (120 MW), Sadah (90 MW), and Mahout 1 (300-400 MW), all targeted for completion by 2027.

In the water sector, Oman is actively expanding its desalination capacity to meet the growing demand for potable water. The Barka V Desalination Plant, with a production capacity of 100,000 cu m per day, was inaugurated in December 2024, representing an investment of approximately RO52 million. GS Inima, a global leader in water treatment industry, is now building a photovoltaic (PV) plant, which will provide approximately 11 per cent of the electricity needs of the desalination facility until June 2044.

Work is under way on the Ghubrah III desalination plant, the largest desalination plant in the sultanate, which will have a capacity of 300,000 cu m per day.

Furthermore, Nama Water Services has signed an agreement worth $142 million for the construction of a new water purification plant at Wadi Dayqah Dam, with a daily production capacity of 65,000 cu m and an anticipated operational date within 22 months. The company is currently undertaking a series of strategic projects valued at over $1 billion, focused on enhancing water transmission lines, expanding storage capacity, and improving sanitation networks across Oman. The company has launched 27 strategic projects worth over RO700 million to further strengthen the nation’s water and wastewater infrastructure.

Oil and Gas

Duqm Refinery and Petrochemical Industries Company (OQ8), which began commercial operations last year with a processing capacity of 230,000 barrels per day (bpd), is mulling plans to expand its scale and diversify the product mix.

|

|

The official groundbreaking for the $1.6-billion Marsa LNG project was held last month. |

Plans for a petrochemical complex in Duqm are also on the anvil, with a feasibility study for the project having been completed.

Oman LNG intends to add a fourth liquefaction train to its existing facility at Qalhat Industrial Complex in South Sharqiyah, which will have a capacity of 3.8 million tonnes per annum (MTPA). KBR has been awarded the front-end engineering design (FEED) contract for this project which is expected to be operational by 2029.

Meanwhile, OQ Gas Networks (OQGN) is actively implementing 10 projects aimed at boosting Oman’s gas transportation capacity. These include the 48-inch Central-Rich-Lean gas (CRL) project and the 42-inch Fahud-Sohar Loop Line, which is expected to add 9 million standard cu m per day (MMSCMD) to the northern gas network by 2027. Furthermore, the company is in the planning stages of developing a 300-400 km hydrogen pipeline network.

Industry

Oman’s industrial sector has demonstrated significant growth, contributing 19.5 per cent to the nation’s Gross Domestic Product (GDP) by the end of June 2024, reaching a value of RO4.09 billion, with manufacturing industries constituting the largest portion of this contribution.

The Public Authority for Special Economic Zones and Free Zones (OPAZ) is actively developing new industrial cities across Oman, including in Mahas, Al Mudhaibi, Thumrait, Seeh Al Sarya, Madha, and Al Suwaiq, to further bolster the sector. By the end of 2024, the total investment in OPAZ-supervised zones soared to RO21 billion, marking a substantial 10 per cent increase compared to the previous year. This includes committed investments of RO6.3 billion in the Special Economic Zone at Duqm (SEZAD), RO6.6 billion in free zones, and RO7.6 billion in industrial cities. Salalah Free Zone has also been a significant driver of industrial growth, with the total investment exceeding RO4.6 billion by June 2024

Among the landmark developments in the industrial sector is the Hyport Duqm green hydrogen project. Currently in the pre-front-end engineering design phase, the project aims for commercial operations in 2030-2031. Hyport Duqm will utilise wind and solar energy with an initial capacity of 1.3 GW, potentially expanding to 2.7 GW. The produced green hydrogen will be converted to green ammonia for export to European and Asian markets via the Port of Duqm’s infrastructure.

.jpg)

.jpg)

.jpg)