SUSAN FURNESS of Dubai-based marketing consultant Strategic Solutions looks at the current demand-supply equation and the trends in the market. With more than 3,500 rooms on the Jumeirah beachfront in Dubai, the destination is going from strength to strength as a 'guaranteed delivery' holiday spot - almost certain sunshine, a working infrastructure, sports and shopping opportunities galore and that touch of the exotic that looks good on postcards.

But is there room for more?

Yes, according to Russel Sharpe, regional senior vice president (sales & marketing) for Le Meridien Hotels & Resorts, which currently manages 20 per cent of that total with its two beach resorts.

His confidence is underscored by the figures - Le Meridien Mina Seyahi Beach Resort and Marina topped the 100 per cent occupancy mark in August while the recently renamed Le Royal Meridien Beach Resort and Spa was in the high 90s, despite building works on the new 154-room deluxe tower.

And, in fact, the latter was already putting up the 'full' sign just a few weeks after opening in September, underlining a growing demand for more than just the standard 'bed and board' package.

For, while the beachfront now has an established popularity as a sunshine destination, the new trend is to take business upmarket, establishing a reputation as an upscale resort environment which appeals to a designer-label clientele that demands, and pays for, a little bit more luxury and personal service.

Increasingly, new developments are geared to this market with flagship properties such as Burj Al Arab, the deluxe Al Maha desert resort, the Arabesque Royal Mirage resort and new deluxe wing at the Jebel Ali Hotel and Golf Course making waves worldwide.

And fitting snugly into this slot is Le Royal Meridien Beach Resort and Spa's Tower, construction of which spurred the decision to upgrade the whole property to 'Le Royal' status - the group's premium brand of which there are just 10 worldwide.

But, while interior decor and amenities are of superior standards, it is the personal attention - that Royal touch - that makes the product one which will appeal to the six-star market.

It is this provision of dedicated service and superior facilities twinned with exceptional demand from markets such as the UK and Germany, which is spurring the gradual increase in rates at the Dubai beach hotels, and perhaps begging the question as to whether this policy can be twinned with long-term sustainable tourism.

In fact, the wheel has come full circle, since Dubai's initial launch into the tourism world in the early 1990s was with the wished-for proviso that only upscale travellers need apply.

An upsurge in new developments entailed strategic pricing to get the Dubai product off the ground, and the concurrent move into (semi) mass markets made the sun'n'sand holiday option one that was very competitively priced, given the standards prevalent in the emirate.

Since that time, worldwide interest in Dubai has surged and, while a string of hotels have opened on the Jumeirah beachfront, demand has been such that rates are rising in tandem, leading some industry observers to wonder if the destination might price itself out of the market.

However, even before the spectacular success this summer when most beach properties enjoyed occupancies in the 90 to 100 per cent range, hoteliers have been quick to justify their pricing rate strategy.

"Pricing is not only justified but very reasonable generally, given the high value-for-money rating the hotels enjoy," stresses Le Royal Meridien's von Brandt. "One should not just look at a rate in the peak season but what is the average rate year round."

It's a view shared by his colleague, Karen Hardcastle, from Le Meridien Mina Seyahi Beach Resort and Marina: "Dubai is now ranked as one of the top ten destinations worldwide and this alone is justification for recent rate increases," she says.

In addition, with a growth in source markets, hotels now have the opportunity to pitch at the top-end traveller in an increasing number of countries: "We are developing new markets such as Italy, France, Australia and Japan - but we have not even started to be proactive in America even though interest is starting to flow from there," she says.

Another factor in the equation is the pattern of future development - although Sheraton Hotel and Towers Jumeira Beach has recently confirmed plans for another 200 rooms, with construction due to start next spring, there are few other concrete plans for more properties on the prime beachfront despite several vacant plots there.

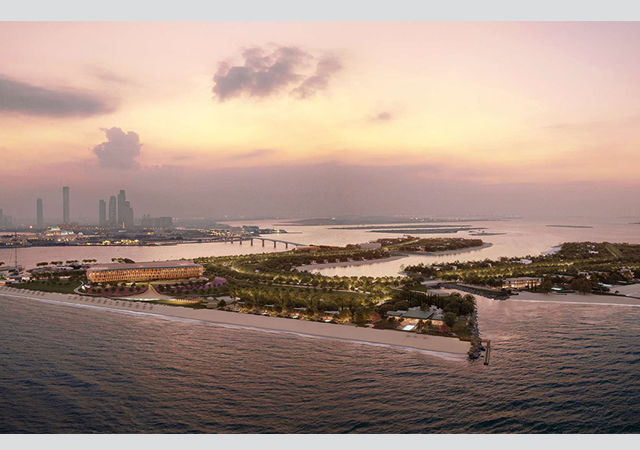

Longer-term, some 20 hotels have been suggested for Emaar's Westside Marina project but with water only just trickling into the initial lagoon site, hotel development is more than a few years away.

So, as Dubai continues to sparkle as both a tourism and MICE (meetings, incentives, conferences and exhibitions) destination - with visitor figures expected to top six million by 2010 - hotels there can be forgiven a slight air of complacency.

"In Dubai, at present, the demand is there," says Campbell.

As von Brandt concludes, while prices are in relation to service and product quality, the destination will continue to succeed: "Let's not sell below our value."

.jpg)

.jpg)

.jpg)