SUSTAINABILITY is now the buzz-word of the Middle East construction industry, with all aspects from materials to structural design coming under scrutiny.

And as regional governments continue to introduce increasingly stringent legislation targeting the sustainability of the growing building stock, changes to the products and construction techniques used are guaranteed. As a major supplier, the concrete industry is well placed to be among the success stories as it adapts to the new expectations, although it will face challenges.

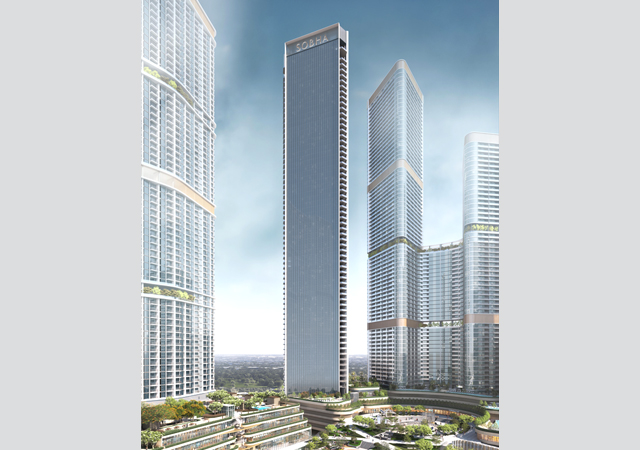

The expanded enforcement of Dubai Municipality’s (DM) Green Building Regulations is the latest move aimed at pushing the construction sector towards a long-term sustainable future. Already mandatory for government buildings from 2014 onwards, these regulations will also become mandatory for private sector projects. Every aspect of a building, from design, planning and execution to operation, maintenance and demolition, must be considered in order to reduce its impact over its lifetime.

Such legislation has opened opportunities across the construction sector. And with materials being a major consideration in sustainable building design, concrete has been thrust into the limelight, with particular growth in the use of precast concrete products. As it is one of the primary materials used in the region’s buildings, any moves towards sustainability and environmental awareness from this industry will have an exponential impact on the overall construction sector. The effects on the concrete industry itself have been numerous and are overall proving to be beneficial.

Achieving a sustainability rating has become a major selling point for building owners aiming to raise their profile, project a certain image and reduce operational costs. Ratings systems such as the US Green Building Council’s Leed (Leadership in Energy and Environmental Design) and Abu Dhabi Urban Planning Council’s Estidama are now referred to as standard on the majority of new-build projects. Their popularity in the region has meant that sectors such as the concrete industry are well prepared for the enforcement of the new Dubai legislation, which is closely based on the Leed system.

|

Over the past few years, the major concrete producers and suppliers have invested significant resources in the research and development of new products and technologies that will raise the product’s sustainability.

In terms of materials used for the manufacture of concrete, the general product mix has changed: the percentage of cement has been greatly reduced and largely replaced by recycled fly ash. As a byproduct of the steel industry, fly ash is primarily a waste product. Recycling this resource to produce concrete reduces the carbon footprint for both steel and concrete industries, giving even greater overall environmental benefits. Plus, given the size of the steel industry in the region, fly ash can be sourced locally, reducing transport costs and fuel emissions and helping to meet the regulations’ demand to use regionally available materials.

The changes to the concrete make-up have had other mixed effects. On a positive note, the product has gained strength. However, it can also take longer to cure and this time difference must be accounted for in the project scheduling. Also, although the cost of fly ash was initially very low, it has increased substantially in line with demand from the concrete industry and this trend is likely to continue.

Other time and cost penalties are being felt in the precast concrete sector in order to meet the tougher thermal transmittance values that the regulations demand for air-conditioned areas.

Arguably, the sector is better placed than many to meet the lower U-values: the naturally high heat resistance of concrete makes it a better choice in many cases than glass or metal facades, despite developments in façade technology. The relatively cheaper cost of concrete, plus new restrictions on the use of glazing are likely to impact this decision. The challenge for design teams is to ensure that the building aesthetics demanded in this region are maintained.

For the precast concrete sector, meeting stricter U-values has meant an update of technology and casting methods. The casting has changed for many exterior wall products as a layer of insulation must be added in order to lower the overall U-value. This has meant bigger casts, plus a three-stage process to complete the sandwich form rather than a single-pour mould. The extra time needed for this production process must again be considered during scheduling.

But one final area where concrete has significant benefits over alternative materials is in whole-life costing. As a primary aim of the DM regulations is reducing a building’s impact over its life, the sustainable credentials of concrete are being increasingly recognised. A low-maintenance material, in the case of prefabricated concrete, there is a large potential for recycling and reusing sections in future projects.

As the enforcement of the regulations fast approaches, the financial and environmental advantages of concrete are making a mounting case for its use as a primary building material. And with sustainability at the top of the list of demands for future buildings, there is a wealth of opportunities for those in the sector who are developing in line with the changing market needs.

.jpg)

.jpg)

Doka (2).jpg)

.jpg)

.jpg)

.jpg)