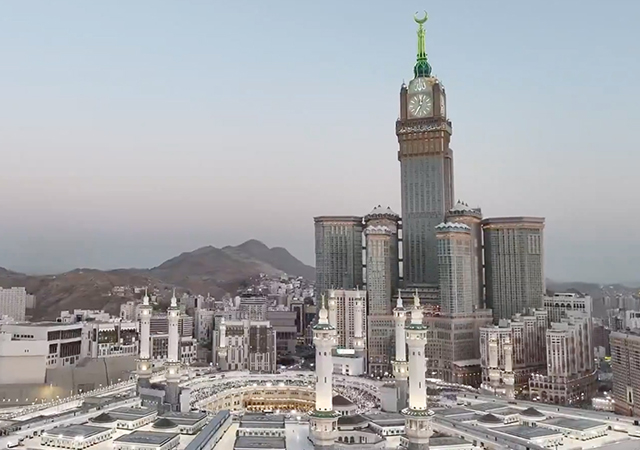

SAUDI ARABIA is the leading construction player in the GCC and will see some $119 billion worth of contracts awarded against the region’s total tally of $286 billion over the 2012 and 2016 period(1).

Demand has been growing in the real estate and the construction sector, although the key hurdles are the lack of availability and the absence of a formal mortgage market. However, enforcement of legislation on mortgages acts as a strong catalyst and could boost the real estate and construction sector. The much-anticipated mortgage law was granted approval by the Saudi Shura Council in March 2011.

Socio-economic factors seem to be more favourable and attractive for Saudi Arabia than its other GCC counterparts, which will bolster the construction sector, hence contributing to the economic growth in the future. Among such factors is the country’s high proportion of young and national population. The presence of larger disposable incomes of the relatively high proportion of young, national, and the growth of the urban population at a healthy rate will sustain the demand for the construction industry in the long run.

Simplification of business start-up procedures and relaxation of the foreign investment law have reduced delays in construction and attracted foreign investment across the construction sector in the kingdom and has helped its healthy growth.

In addition, oil prices are expected to be stable by the end of 2012 and will have a positive impact on the GDP growth and the construction sector, in particular, during the medium- and long-term period.

A strong emphasis on infrastructure expenditure is expected to drive medium-term economic growth in Saudi Arabia, where projects worth $2.8 trillion are under way. The government’s commitment towards infrastructure development, privatisation, and diversification programme in the non-oil sectors, such as building of economic cites in the country is fuelling growth of the economy, which in turn will drive the growth of the construction and infrastructure sector.

Saudi Arabia, the largest market for infrastructure development, is likely to embrace the public-private partnerships (PPP) model. With government-backed infrastructure projects planned over a spending period of five years,including low-cost housing schemes, the infrastructure sector is expected to grow in the country.

Apart from infrastructure projects, the growth of the construction sector is primarily led by the residential and mixed-use commercial development, mainly fuelled by the large demand-supply gap in the residential sector. The key focus area of the residential construction sector in Saudi Arabia has now shifted to providing affordable homes to the low- and middle-income group population.

The highly-sustained growth of the construction industry in Saudi Arabia has attracted the latest technology, material, and equipment compared to its GCC counterparts.

Although the government is encouraging sustainability, green construction, and smart buildings in the country, a lack of legal enforcements leads to an immature growth of the construction industry. Implementation of Saudi Arabian Green Building Council is expected to impact high growth of the construction industry in the medium and long term.

REFERENCES

1 Meed Projects.

* Frost & Sullivan is a growth partnership company that enables clients to accelerate growth and achieve best-in-class positions in growth, innovation and leadership. The company provides disciplined research and best practice models to drive the generation, evaluation and implementation of powerful growth strategies.

Link to Factors impacting the construction market opportunities in Saudi Arabia

.jpg)