2000 is likely to go down as a watershed year in Saudi Arabia's history . April 2000 saw the announcement of the Foreign Investment Law, which permits non-Saudi companies to wholly own their investments and property in the kingdom without a Saudi partner. While observers would complain that liberalisation has been slow in happening - a definite change is pervading most sectors of the economy, albeit cautiously.

The most recent and among the most striking developments is the award last month by the Saudi Arabian General Investment Authority (Sagia) of a licence to a US consortium to build 3,000 schools in the kingdom at a total cost of SR13 billion ($3.5 billion). Sagia said the firms will carry out the project on a build-operate-transfer basis for the Education Ministry. The government currently uses 700 rented buildings to operate schools in different parts of the country. The licence is the largest since the kingdom opened up for foreign investments a year ago.

In addition to attracting investment to the kingdom, the new foreign investment law is seen as helping Saudi Arabia's four-year bid to join the World Trade Organisation (WTO). The goal of WTO membership has been set partly to attract foreign investment (up to $200 billion over the next 20 years, according to Foreign Minister Prince Saud), and also to to secure new markets for the country's petrochemical industry.

Saudi Arabia last year also established the Supreme Petroleum Council (SPC) to oversee oil and gas policies in the country. In mid-October 2000, the government announced that the Council would take over certain powers over Saudi Aramco. The SPC could help push Saudi Arabia's overall goal of accelerating private sector and foreign involvement in the country's oil sector, although there is opposition by conservatives.

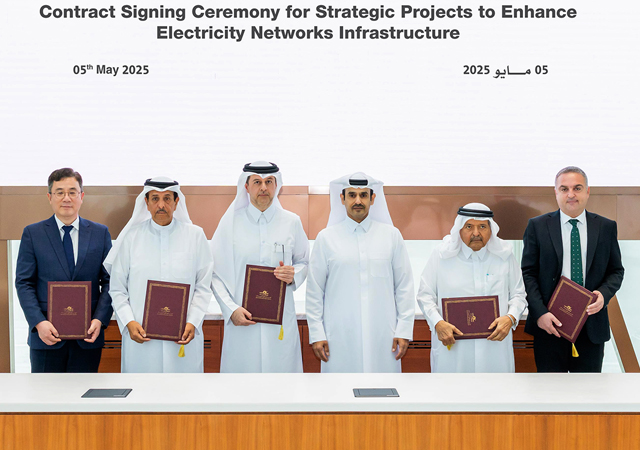

Additionally, Saudi Arabia restructured its telecommunications sector and electricity industry allowing private investors to play a bigger role in the economy.

April 2000 also witnessed the birth of the Saudi Electric Company (SEC) with a capital of $9 billion as a prelude to privatisation. SEC was formed from the country's 10 regional power companies, including the four Scecos Ñ East, West, Central, and South Ñ which controlled 85 per cent of the country's power supplies.

The government announced that it planned to invest as much as $117 billion by 2020 to meet demand and grant concessions to the private sector in order to construct new power plants on a build-own-operate (BOO) basis. The future of IPPs (independent power producers) in Saudi Arabia remains uncertain, however, with major challenges including: tariffs, legal and operating framework, taxation, and fuel supply.

Saudi Arabia's new Five Year Plan, unveiled in August 2000, projects GDP to expand by an average of 3.16 per cent a year in real terms. According to the plan, the private sector is to spearhead growth - private sector investment is targeted to increase by 5.04 per cent a year to total $127.6 billion over the five years. Diversification is expected to reduce the non-oil sector's contribution to GDP to 71.6 per cent in 2004 from 68.4 per cent in 1999. Mining and petrochemicals are tipped to show the fastest growth, at 8 per cent, followed by manufacturing and construction (6 to 7 per cent).

The healthy oil prices have greatly eased the financial constraints faced by the Kingdom over the recent past. However, most of the windfall earnings have been channelled into debt reduction.

Over the past year, most of the construction activity has been driven by the oil and gas sectors, and petrochemical and industrial construction and expansion, spearheaded by Saudi Aramco and Saudi Basic Industries Company (Sabic).

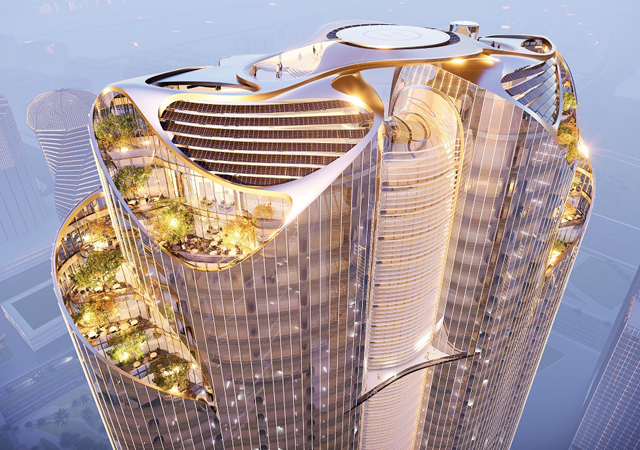

Major new building projects such as the likes of Riyadh's showpiece towers- the Al Faisaliah Tower (opened last year) and the Kingdom Centre (under construction) - have not surfaced, despite reports that new 30-storey towers have been granted the green signal. Both the Al Faisaliah Tower and the Kingdom Centre were a source of considerable business for local contractors (see Page 85).

Among other developments, airport construction is a significant growth area, with a major expansion planned for Jeddah's King Abdul Aziz International Airport. Netherlands Airport Consultants (Naco) was appointed to provide design consultancy services for the expansion and renovation of the airport.

In addition, domestic airports are planned for Dawadmi and Jizan. Plans for an international airport at Makkah are reported to have been shelved.

The tourism sector continues to be reeceive encouragement angled, however, more at the domestic and GCC tourist. Investment has been pouring into Jeddah, Abha, Baha and Taif in recent years with the focus being on a family-type entertainment.

With 3 to 4 million people visiting the holy places every year, religious tourism remains substantial and considerable funds continue to be poured into the development of Makkah and Madinah.

Power & Water

Development and expansion of Saudi Arabia's economy, coupled with high population growth, has resulted in a surge in the demand for electric power. The power industry is having to expand to alleviate capacity constrains and this is opening up vast opportunities for investors.

Several projects now under way employ financing mechanisms that are new to the sector. The 1,200 MW, PP9 power station north of Riyadh has been funded with extra revenues generated by a special tariff imposed on heavy users since January 1995. The $1.7 billion Ghazlan II power project in the Eastern Province is being financed by an internationally-syndicated $500 million commercial loan (the first such loan in Saudi history), and being built by a consortium led by Mitsubishi and Bechtel. Ghazlan II consists of four, 600-MW steam turbine units, which are expected to come online by 2002.

Work is nearing completion on the first unit of the $1.7 billion, 1,100-MW, gas-fired power plant at Shuaiba on the Red Sea. ABB Asea Brown Boveri is the turnkey contract for the project which comprises three generating units.

Meanwhile, the go-ahead has been given to expand the Shuaiba station at a total cost of SR1.5 billion. Alstom Energy (France) has won the lumpsum turnkey contract involving installation of the fourth and fifth generating units with a combined generating capacity of 750 MW. This station plays a key role in upgrading the electric supply to some of the main cities such as Makkah, Madinah, Jeddah and Taif. The fourth unit will enter into service in August 2003 and the fifth unit will follow subsequently.

Transmission and distribution contractors are preparing to bid for a number of new tenders issued by SEC, pointing towards a new round of activity in the sector. Transmission projects include new substations in the western, central and northern regions, while distribution work includes overhead lines in the western region.

Japan's Sumitomo Corporation has been licensed by Sagia to create a joint venture company to build a $2.2 billion power and desalination plant in Jubail. The plant is expected to be built on a BOO or build-operate-transfer (BOT) basis and is designed to generate 700 MW of electricity and produce 730,000 cu m a day of water.

In January, Middle East Engineering and Development Company (Meedco - local/South Korea) secured a $52.8 million deal from SEC for establishing a power link between Shedgum, Hawiya and Haradh in the Eastern Province.

A new utility company has been set up in the twin industrial cities of Yanbu and Jubail. The company, named Marafeq, is being founded by the Royal Commission, the Public Investments Fund, Saudi Aramco and Sabic, with local investors also holding a stake in the company.

Bids are being evaluated for the engineering, procurement and construction (EPC) of a power station at the Al-Khafji Neutral Zone base of Aramco Gulf Operations Company (AGOC) and Japan's Arabian Oil Company (AOC). The estimated $100 million project involves construction and installation of a power plant comprising three 30-MW gas turbine units.

A 126-MW, gas-fired plant at the Saudi Aramco facility at the huge Abqaiq oil field is also to be built.

Several new desalination plants are under way and once completed the network will have a capacity of 800 million gallons a day. The plants currently generate 3,600 MW of electric power and this will rise to 4,500 MW when the new desalination plants are up and running.

Oil & Gas

For international engineering and contracting firms, opportunities now abound, particularly in the expanding gas sector. JGC Corporation has been awarded a $450 million contract by Saudi Aramco to build a 1.6 billion cu ft natural gas processing plant in Haradh. Construction is scheduled for completion by the end of 2003.

In January, JGC awarded CCC Saudi Arabia a $150 million deal for all construction works on the Haradh project. The main contractor have also awarded subcontracts for the supply and installation of the automation systems for the plant and is expected to award the structural steel contract soon.

Suedrohrbau Saudi Arabia (local/Netherlands) is carrying out the third pipeline package on the Haradh gas development involving constructing the gas gathering pipeline, 69-kV overhead power lines, three manifolds and access roads under a $55 million deal from Saudi Aramco.

Italy's Snamprogetti, the engineering unit of Eni, has signed a turnkey agreement with the Saudi oil conglomerate to build a $140 million gas-fired oil separation plant in Haradh. The plant, which will take 25 months to complete, will provide additional production capacity for the field in Haradh.

Over the past two months, Saudi Aramco has awarded two other $100 million-plus projects. These include a $140 million deal to Snamprogetti (Italy) to carry out the lumpsum turnkey phase two of the Haradh Arabian Light crude increment project; and a $110 million contract to also Snamprogetti for implementing the Khuff fractionation project at Ras Tanura.

Industry

Sabic and its affiliates continue to expand in the petrochemical sector, boosting prospects for contractors and suppliers in the construction sector. Jubail United, a wholly-owned affiliate of Sabic, is building a 450,000 tonnes per year (tpy) polyethylene plant at Jubail. The plant will have a swing-capacity to produce linear low density and high density polyethylene. It will source ethylene feedstock from Arabian Petrochemical Company ((Petrokemya), another Sabic-owned affiliate.

Japan's leading chemical plant engineer Toyo Engineering Corporation in January, reached an agreement to build a polyethylene unit with a capacity of 400,000 tpy, to be completed in 2003. TEC is currently building an ammonia plant for National Chemical Fertilizer Company.

The petrochemical sector is attracting considerable private investment, among the latest being the Saudi International Petrochemical Company (SIPC), set up by private investors. SIPC is setting up a $850 million three-factory complex in Jubail including 850,000 tpy methanol and 140,000 tpy carbon monoxide production facilities which are under construction. SIPC is now setting up a butendiol project, construction of which is slated to begin early next year with production expected to start by the end of 2003. The plant will produce 50,000 tpy of butendiol and 10,000 tpy of malic enhydride.

National Petrochemical Industrialisation Company is developing a $240 million, 280 tpy polypropylene plant in Yanbu. The Saudi Industrial Development Fund (SIDF) will finance around $107 million of the $240 million, private investors will supply $70 million and the remaining finance will be supplied by bank loans.

The local Alujain Corporation will build a $425 million iso-octane plant and a $285 million propylene plant. The plants are both expected to come on stream in 2004. The 900,000 tpy iso-octane plant is replacing the original methyl tertiary-butyl ether (MTBE) project, originally planned by the firm.

The propylene plant at Madinah Industrial City will have a capacity to produce around 350,000 tpy polymer grade propylene. The unit will supply a new 250,000 tpy polypropylene plant that is to be built by the Basell/Natpet joint venture, Teldene, at Yanbu.

Sagia has issued a licence to British firm Zinc Resources to produce 100,000 tonnes of high-quality zinc from the Red Sea city of Yanbu at a total investment of SR958 million. The project, the first of its kind in Saudi Arabia, also involves setting up a factory to produce sulphuric acid and a water treatment plant.

Since its establishment last year GIA has granted 91 licences with total investments of SR30.5 billion, SR2.86 billion of which was foreign capital.

A contract has been signed for the construction, development and operation of a new industrial estate in Al Kharj with the International Industrial Estate Development Company, an International Real Estate Holding Group company. The project, which will cover an area of a million sq m along East King Fahd Road, will comprise of 320 plots of land.

Economic feasibility studies are under way for a new industrial park in the Park West site of Jubail Industrial City. The project, which is aimed at larger industries, is still in the stage of conceptual analysis, according to the Royal Commission for Jubail and Yanbu. The project could cost up to $1 billion and phases of it could be commissioned by 2008. The consultant is Nexant, a UK-based subsidiary of the US' Bechtel which built most of the original industrial city.

Roads

Saudi Arabia has finalised plans for several new road projects with a total cost of SR20.2 billion ($5.4 billion), Transport Minister Nasser Al Salloum said. The roads, extending a total distance of 3,950 km, will link major cities with remote provinces, he added.

Salloum said the ministry has placed a 990-km road linking, the province of Qassim, northwest of Riyadh, to the city of Haditha on the border with Jordan, at the top of its priorities. No time frame was given to complete the projects.

Saudi Arabia has more than 50,000 km of paved roads and maintenance of these roads is another lucrative area for Saudi contractors. Some 60 contracts worth $368 million for maintaining more than 45,000 km of highway were awarded to 29 local contractors by the Communications Ministry late last year.

A major rail expansion project is expected to go ahead, after the government dropped a demand that the builder would have to pay billion-dollar compensation bills towards land used by the project. The expansion, which will link the eastern coast with the western coast and the northwestern part of the country with Riyadh, is projected to cost more than $3.2 billion (see pg 135).

Health

A number of hospital projects given the go-ahead over the past year including 200-bed hospitals in Biljurshi, Al Henakiah, and Sakaka, estimated to cost SR160 million, and a 500-bed hospital in Mina which could cost about SR 500 million. In addition, at least eight 50-bed hospitals throughout the kingdom have been put to tender recently. A further four new hospital are to be built in the Makkah region, in Zalam, Turaiban, Khulais and Quba in Al Hareth.

A $36 million contract to build a new 200-bed general hospital in Rass, Qassim was awarded to Al Mansouriya Trading and Contracting Company in August last year. Five contracts, worth a total of $101.9 million, for building, operating and maintaining nine hospitals throughout the country were awarded late last year to local companies Fad Company, Zahran Group, Projects for Health Programs and Al-Ewan Medical Company.

Meanwhile, the Ministry of Finance and National Economy has provided SR50 million towards for the construction of a private hospital in Riyadh. The hospital will have 300-bed capacity. This is the 16th such project which has been financed by the ministry.

A new ministerial committee is being set up to look at an integrated approach to future health infrastructure requirements. The committee will be headed by Planning Minister Khaled bin Mohammad Al Gosaibi and will include representatives from the kingdom's specialist and military health institutions as well as from the private and charitable sectors. The move is expected to give a considerable boost to governmental and private healthcare projects while updating and streamlining the sector.

Outlook

What can the construction sector expect over the long and short term? With greater investment expected in the power and water, roads and railways, schools and hospitals sector, prospects look brighter for the coming year.

With greater demands for housing, the private sector will be increasingly urged to develop quality housing for Saudi Arabia's burgeoning population.

According to Kevin Taecker, a leading expert on Saudi economy: ''Different factors are driving the trends, but there are many positive elements in the outlook for demand in both the large and small segments of the construction sector's market.Ê

''For the large, the costs of new projects and infrastructure associated with plans to open the domestic energy sector for international private development and to meet the Kingdom's rising electric power and water requirements are enormous - taken altogether, upwards of $200 billion over the next two decades.Ê

''As for the small construction companies, the demographics have set in motion a structural shift in the economy, where new household demand is much less related to the ebb and flow of expatriates and much more related to the coming of age of a whole new generation of Saudis.Ê For the next generation, at least, the demands for new housing, commercial outlets and municipal services can be expected to rise at rates at or above the estimated new household formation rate for Saudis of about 6 percent per year.''

The new foreign investment laws and the opening up and liberalisation of its construction, will undoubtedly attract greater international competition into the market, says Taeker, who was previously a chief economist at Saudi American Bank (Samba) and who has now set up a Washington-based consulting practice called Enterprise KSA.

''What will globalisation do to the small company segment?Ê Competitive pressures will rise, no doubt, but because of the nature of the work, many strong small local construction companies will do well even in the most open and competitive markets.Ê The competitive challenge is being able to advance the quality of work they can perform, and the techniques that they use to accomplish it,'' he says.

.jpg)

.jpg)

.jpg)

.jpg)

Doka.jpg)