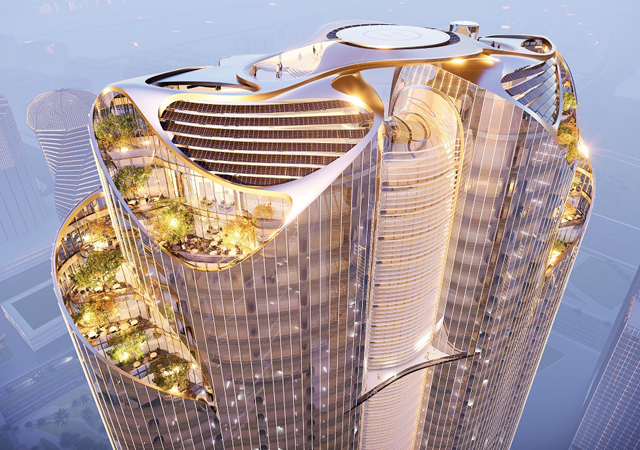

Ras Tanura ... upgrading its facilities.

Ras Tanura ... upgrading its facilities.

THE recent establishment of the Saudi Arabia General Investment Authority (SAGIA) to encourage and facilitate foreign direct investment (FDI) and improve its investment climate should increase Saudi Arabia's share of FDI over time. Gas, utilities and telecommunications sectors seem to be of most interest to potential international investors to date, with great opportunities upcoming.

Developing a balanced budget for 2001, Saudi Arabia has allocated approximately $10 billion for the construction of schools, hospitals, roads, water and sewage facilities. Together with higher anticipated private sector investment in commerce and industry, Saudi Arabia now provides the platform for a higher rate of economic growth than has occurred in recent years.

Saudi Arabia is emphasising human resource development (HRD) at 25 per cent of the 2001 budget, having the largest aggregate expenditure and 8.15 per cent growth. Health services and social development comes next with 11 per cent of the budget and 10.05 per cent growth, then municipal services and water at 4 per cent of the budget and 22.4 per cent growth. Utilities, infrastructure and economic resource development are now left more to the private sector.

Government budget allocations realistically relate to high demographic growth, currently estimated at 3.85 per cent, placing a great burden on government resources. This does not leave much room for paying down debt, now estimated at nearly 100 per cent of GDP, or developing utilities and environmental enhancement required for expanding industrialisation.

Large national corporations are not holding back, as indicated by Saudi Aramco and Saudi Basic Industries Corporation (Sabic), expanding capacity in hydrocarbon projects, with contracts and bids under way. Examples for Aramco are the $1.3 billion Haradh and $350 million gas/oil separation (GOSP) development, the refinery upgrading at Ras Tanura and additional gas distribution facilities. Sabic is involved in a new grassroots olefins project estimated at $2 billion and several affiliates are planning de-bottle-necking projects in the chemicals and fertiliser divisions.

The Royal Commission for Jubail and Yanbu is expanding utility facilities and new industrial infrastructure projects to keep pace with expected industrial development.

Housing

Saudi Arabia's indigenous population is set to double over the next 20 years, posing a serious challenge to develop jobs, maintain acceptable income levels for citizens and create housing for the rapid household formation projected in the Seventh National Plan. However, most government projections assume household formation according to past trends, but this does not adequately account for a declining trend (except last year) in per capita incomes due to population growth far exceeding economic growth. Therefore, remodelling and smaller home investments may surpass construction of new housing units due to young families and singles forced to live with parents as a result of economic constraints.

A recent three-day symposium in Riyadh discussed ways to tackle the housing problem in the city whose population is expected to grow at a rate of eight per cent annually. Riyadh's population is expected to exceed 10.5 million in 2022, requiring an additional 1.5 million housing units. The total area of the city is expected to increase to 1,800 sq km in the next few decades from the present 800 sq km, resulting in large amounts of infrastructure and commercial construction in addition to housing needs.

A basic question facing residential and infrastructure development is whether new technology and development schemes, including institutional and financial innovations, will come forth as rapidly as demand expands. If historical growth patterns of the economy persist in the next decade as in the past, it will only be through new and innovative means that development demands can be met. There is nothing on the horizon to indicate economic growth will, in the future, surpass population growth to redress the huge imbalance exhibited in the Saudi economy.

The Seventh Development Plan (2001-2005) has established growth objectives that could be hard to achieve.

The construction sector is targeted for 6.17 per cent growth, whereas the historical growth during the previous Sixth Development Plan was only 2.9 per cent, or a very large variance or difference of -3.27 per cent. More importantly, many of the sectors targeted for high growth in the new Seventh National Plan, that the construction sector builds its growth upon, exhibit similar wide variances between planned and actual.

It should also be noted, however, there is historically a two-to-three year time lag between increased oil prices and resulting expenditures on construction projects.

Expected growth in the construction sector should reside somewhere between planned and historical actual, primarily due to recent high oil prices providing additional revenues to government. Nevertheless, government has shown great constraint in developing new projects, preferring to pay down a large national debt.

Together with fast population growth and resulting household formation, the economy is expected to maintain its recent positive growth, although far less than optimum due to excessive consumption expenditures relative to productive investment in the economy. Domestic productive investment has been limited to date due to high outflows of Saudi Arabia private investment and low inflows of FDI, both following higher return potential elsewhere. If provided improved information and analyses of sector opportunities to domestic and foreign investors, this can be reversed.

The construction sector has the advantage of being a fully private sector with current excess capacity composed of numerous small and medium enterprises (SMEs). This avoids the situation as in many developing countries where the construction sector has been dominated by large state-owned public sector firms, inefficient and often loss leaders. With excess capacity in the construction sector, plus need to develop cash flow to remain solvent by numerous SMEs, it is fully expected that bids will remain low and highly competitive over the near and longer term.

Financing

Financing for the construction sector requires some form of de-bottle-neck operations as is evidenced in modernizing most industries today. Probably the greatest constraint for SMEs in the construction sector is adequate access to timely and favourable financing.

Development banks in the GCC have traditionally depended on governments as source for their funds. Most are facing difficulties in replenishing funds due to increasing government debt and social overhead.

Additionally, when joining the WTO, interest-free loans will not be allowable as they are considered subsidies under border price calculations for equitable trade rules.

The GCC, as maturing economies, should create a "family" of development banks offering a market basket of securities thereby attracting available international capital. This would alleviate GCC governments of the burden of funding development banks while spreading risk for potential investors.

Conclusion

In summary, growth in the construction sector in the Kingdom is expected to continue driven more by expanding population and associated infrastructure requirements than on any other factor. The rapidly expanding population places such large demands on government resources that little excess is left for projects. Therefore, government is looking to the private sector to take up the slack. But due to low domestic and FDI, low productivity in a slowly diversifying industrial base and difficulty in competing in the global markets without internationally recognised brand names and associated quality attributes, industrial project growth will also be slow but steady.

It is interesting to note that Saudi Arabia has been able to successfully compete in basic and intermediate products produced in great volume in capital-intensive industries, but most final products and labour-intensive industries are not very competitive, but in a few rare cases.

Nevertheless, slow but steady growth is a much better scenario than in other regional economies, where political instability and questionable macro policies make growth in most sectors, including the construction sector, a worse scenario than in the Kingdom.

SMEs in the construction sector must continue to look for opportunities forthcoming from larger industries operating in oil, gas, petrochemicals, utilities, telecommunication, and in the near future mining. Additionally, niche market opportunities continuing to come unannounced and in spurts as diversification in the economy sporadically occurs. Increased opportunities await slow institutional reforms under way that currently create bottlenecks to more rapid development of the economy.

.jpg)

.jpg)

.jpg)

.jpg)

Doka.jpg)